Most submission triages never even make it past the first read.

Not because the risk is bad or the rate’s too high. But because the submission itself is a mess.

Ask any underwriter, and you’ll hear the same thing – more than 70% of submissions are incomplete, inconsistent, or impossible to quote without hours of cleanup.

And in commercial and E&S markets, where speed wins and underwriters are buried in volume, messy means ignored.

This article breaks it all down:

- What a good submission triage actually looks like

- Why most fall short

- The most common errors agents and MGAs make

- And how AI-powered triage (like Bound AI’s Submission Triage Agent) can fix the mess before it costs you premium

Because the truth is, underwriting isn’t slowing down. It’s just getting more selective about what’s worth their time.

Book a Bound AI demo.

What Underwriters Actually Want

It’s not complicated. Underwriters want to make good decisions quickly.

But they can’t do that if they’re guessing what’s missing, flipping through 30-page PDFs, or chasing brokers for basic data.

So what does a quote-ready submission actually look like?

A. It’s Complete

At a minimum, underwriters expect:

- Loss Runs – Usually 3–5 years, in chronological order, clean and legible

- Applications – Filled out completely, with accurate answers (no “TBD” or blank risk details)

- SOVs – Formatted correctly, not buried in locked Excel sheets or screenshots

- Supplementals – Especially for complex lines like property, trucking, or cyber

- Broker Notes – Context helps: any nuances, known losses, or placement strategy info

Without this core package, the underwriter can’t even begin to assess the risk properly.

B. It’s Structured

Underwriters don’t want a document dump.

They want to open a submission and know exactly what they’re looking at. That means:

- Clear file names (not “scan1234.pdf”)

- One document per file, not 15 items jammed into one PDF

- Logical labeling: “Loss Runs 2020–2024,” “App – Property,” “SOV – Location A”

The faster they can navigate the file, the faster they can get to quoting.

C. It’s Consistent

Nothing creates more doubt than inconsistency.

- If the app says 15 vehicles but the SOV lists 12 – what’s the truth?

- If the loss run says one thing, and the broker email says another – who’s right?

- If the COPE data is missing for one location but not others – can this be trusted?

Underwriters want data that aligns across documents. If they spot too many mismatches, they’ll either delay the quote or decline altogether. Underwriters don’t want perfect, just usable.

Where Most Submissions Go Wrong

The problem isn’t that underwriters are picky. They’re busy.

When a submission lands in their inbox, they make a quick judgment: Can I quote this without doing detective work? If the answer is no, it’s often faster to move on than to chase down what’s missing.

Here’s what typically derails a submission:

- Missing documents are the number one killer. Loss runs are outdated or not included. The application is half-filled. There’s no SOV. Underwriters can’t price what they can’t see.

- Formatting nightmares come next. SOVs arrive as locked PDFs or bloated Excel sheets with broken formulas. Loss runs are scanned sideways or combined with unrelated documents. Even simple file names like “App_final_final_v3” make navigation painful.

- Conflicting data erodes trust. The number of vehicles doesn’t match between the application and the SOV. The broker email says there’s been no loss activity, but the loss run says otherwise. These red flags slow everything down.

- Incomplete answers force underwriters to either guess or follow up. “N/A” in a required field is not an answer but liability.

- Irrelevant attachments clutter the process. Marketing decks, broker resumes, and duplicate docs from past years- none of them help the underwriting process. All of it wastes time.

Even one of these issues can delay a quote. Stack a few together, and the submission falls to the bottom of the pile or straight into the decline bin.

And here’s the real kicker: most brokers or MGAs don’t even realize their submissions are the problem. They blame turnaround time or appetite, when in reality, the quote died before the underwriter even got started.

Why This Costs Everyone Time (and Premium)

Messy submission triages sets off a chain reaction of delays.

The underwriter spends more time piecing together documents than evaluating risk. They follow up with brokers, hunt down missing files, and make assumptions just to move the process forward. And while all of that’s happening, faster-moving competitors are already quoting.

MGAs and agents often lose deals without ever realizing the cause. They think the quote was too high or that the market just wasn’t interested. But more often, it wasn’t the rate or the risk. It was the package.

In this industry, the submission that quotes first has the best shot at binding. But you can’t quote fast if you’re stuck fixing broken files.

Even when a quote is issued, sloppy submissions can lead to future problems, including misquoted risks, incorrect limits, and compliance issues that surface during audits. And all of it feeds back into the cycle of rework, delays, and lost premium.

Clean submissions don’t just save time. They win business, protect margins, and build trust.

What a “Clean” Submission Looks Like (and How to Get There)

You need clarity over perfection. A clean submission gives underwriters everything they need without making them search for it.

In a clean submission:

- All required documents are present and logically labeled.

- Loss runs are readable and sorted by year.

- The application is filled out completely, with consistent data across all files.

- SOVs are in a usable format, not locked spreadsheets or scanned pages.

- There’s no clutter, just relevant, structured information.

A good submission feels easy to quote. An underwriter shouldn’t have to scroll, click, and decode just to figure out what they’re looking at. Everything should be packaged with intent: this is the risk, here’s the supporting info, and nothing’s missing.

Getting there consistently means standardizing intake. Most brokers and MGAs try to do this manually, reviewing every file before sending it out. But at scale, that becomes a bottleneck of its own. That’s where automation, specifically intelligent triage, starts to matter.

Because the quote-ready submissions are rarely the prettiest. They’re the cleanest. The clearest. The fastest to act on.

How Bound AI Fixes Submissions Before They Hit the Desk

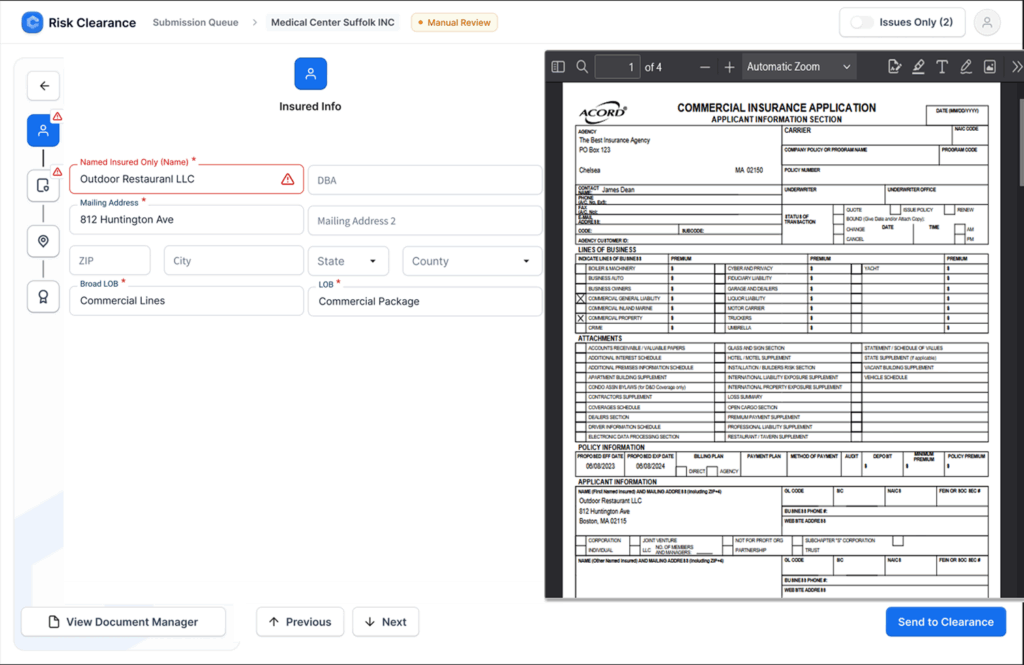

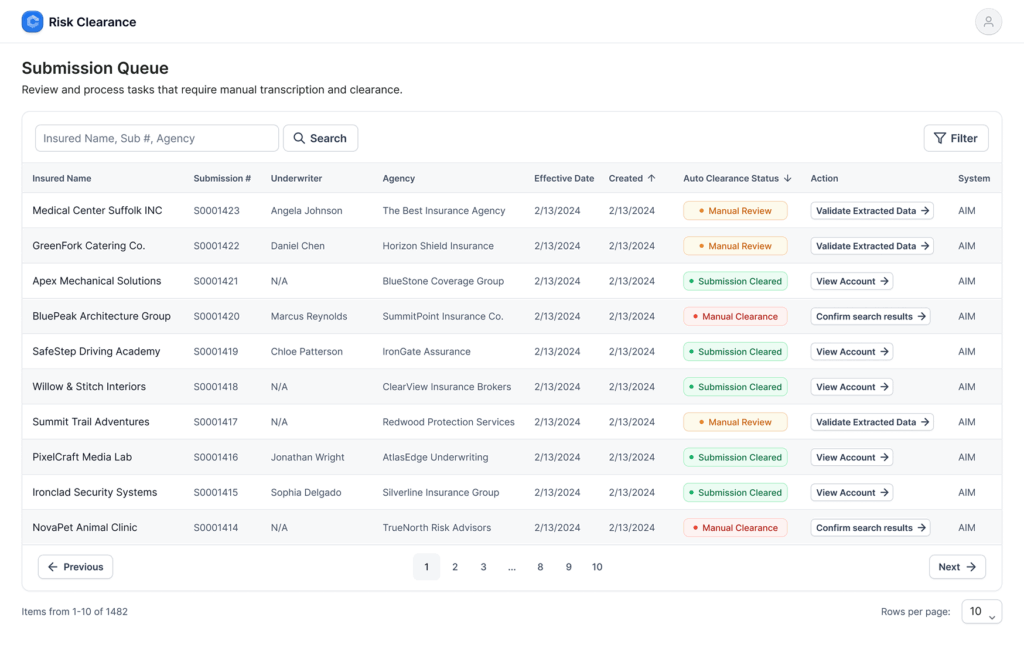

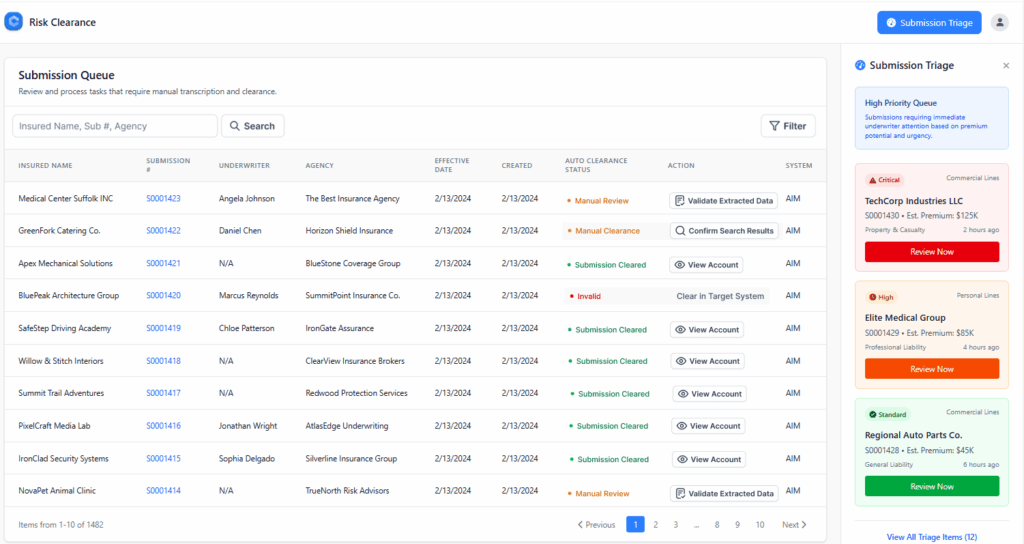

You no longer need to manually fix bad submissions. Bound AI’s Submission Triage Agent automates the cleanup before the underwriter ever sees the file.

Here’s how it works:

As soon as a submission comes in (via email or upload), the agent scans the contents – documents, attachments, and even the body of the email. It identifies the line of business, extracts relevant metadata, and checks for completeness.

Missing a loss run? Incomplete SOV? Application not attached? Bound AI flags the gaps immediately.

It also checks for consistency, ensuring that data across documents doesn’t conflict, and removes anything irrelevant, such as duplicate files, marketing decks, and scanned pages that don’t belong.

Then it packages the submission with clean, standardized file names and applies tags like “Incomplete – Missing App” or “Ready for Quote – All Docs Present.” That lets underwriting teams triage faster, prioritize better, and move quote-ready files to the top of the queue.

No more detective work. No more hours wasted on manual checks. Just fast, structured submissions that speak the underwriter’s language.

That’s the point of intelligent intake: to make it easy to say yes.

The Bottom Line

Underwriting isn’t slowing down. But most submissions are still stuck in the past – messy, inconsistent, and nearly impossible to quote without cleanup.

It’s costing MGAs and agents time, trust, and premium.

Underwriters don’t want more information. They want the right information packaged clearly, delivered cleanly, and ready to quote.

Bound AI makes that the default, not the exception.

If your submissions are still getting stuck in inboxes or declined without a response, it’s time to stop blaming the appetite. And start fixing the file.

Book a Bound AI demo.