AI Co-Pilots Built for Specialty Lines

Your Underwriting Support Desk,

Now Autonomous

Speed gets you there first. Accurate data keeps you there. You need both. Bound AI equips your team with insurance-native AI agents that read, extract, and validate policy data in record time. You can act on every opportunity before it slips away.

Trusted by the Most Ambitious E&S Partners

What's Slowing You Down

Fragmented

Data

You’re buried in submissions and missing deals because you lack the data needed to generate a quick quote, confidently bind the risk, and outpace your competitors.

Disconnected

Systems

Technology is in place, but you’re still stuck rekeying data, dragging & dropping, or jumping between systems that don’t sync, losing your precious time.

Lagging

Turnaround

Times

Manual intake, scattered data, and disconnected systems slow everything down. If you’re not first to quote, you might not bind at all.

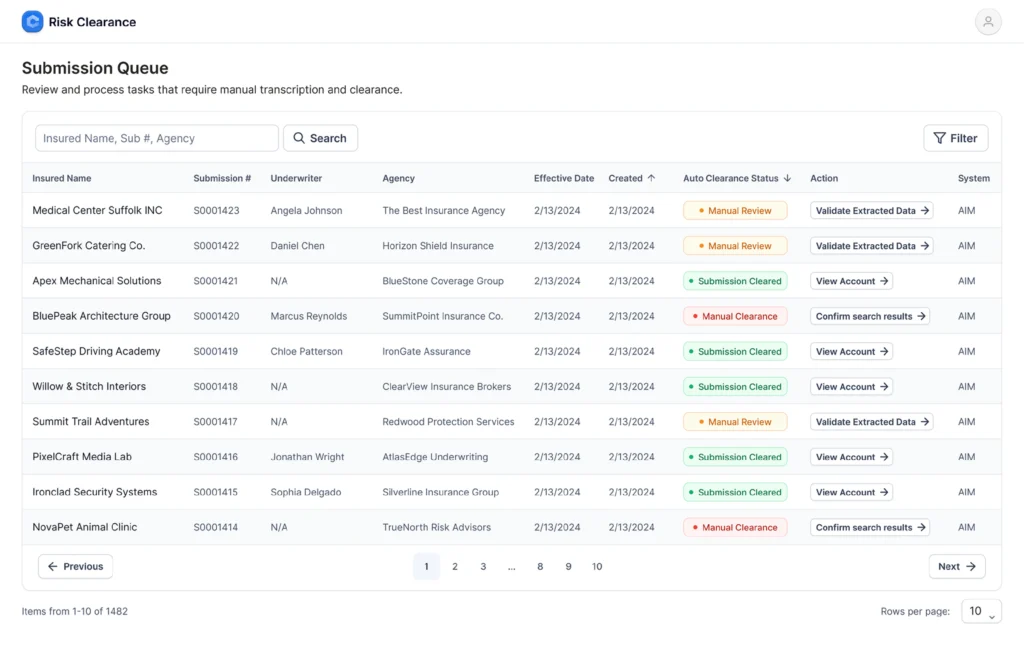

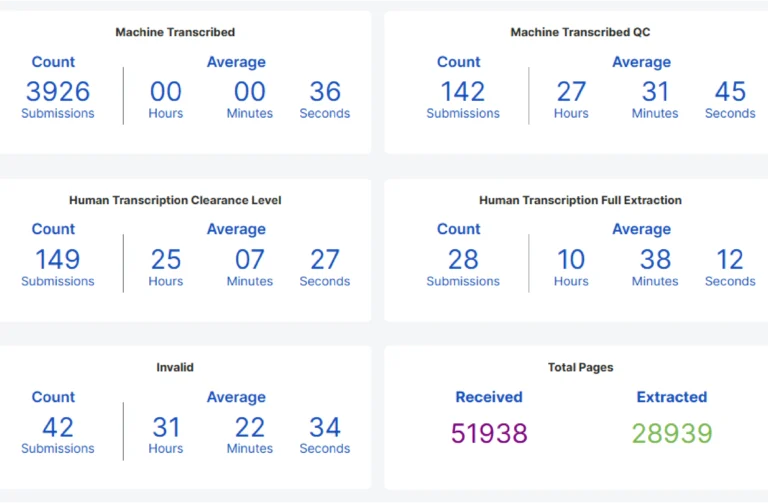

Risk Clearance AI Agent Built for Submission Ingestion

Bound AI delivers straight-through policy processing by transforming the most

critical risk clearance documents into clean, ready-to-use data:

ACORDs

loss runs

Proprietary supplemental applications

SOVs

Metric

Before Bound AI

With Bound AI

Metric

Before Bound AI

With Bound AI

Insurance Workflows You've Been Waiting For

AI That Understands

Insurance Documents

Eliminate manual entry with AI agents trained for

every key insurance doc – ACORDs, loss runs, SOVs,

supplements, etc.

Using proprietary computer vision and generative AI,

Bound AI instantly extracts, structures, and validates

data, expediting submission-to-quote time, improving

accuracy, scaling capacity, and helping you grow your

book.

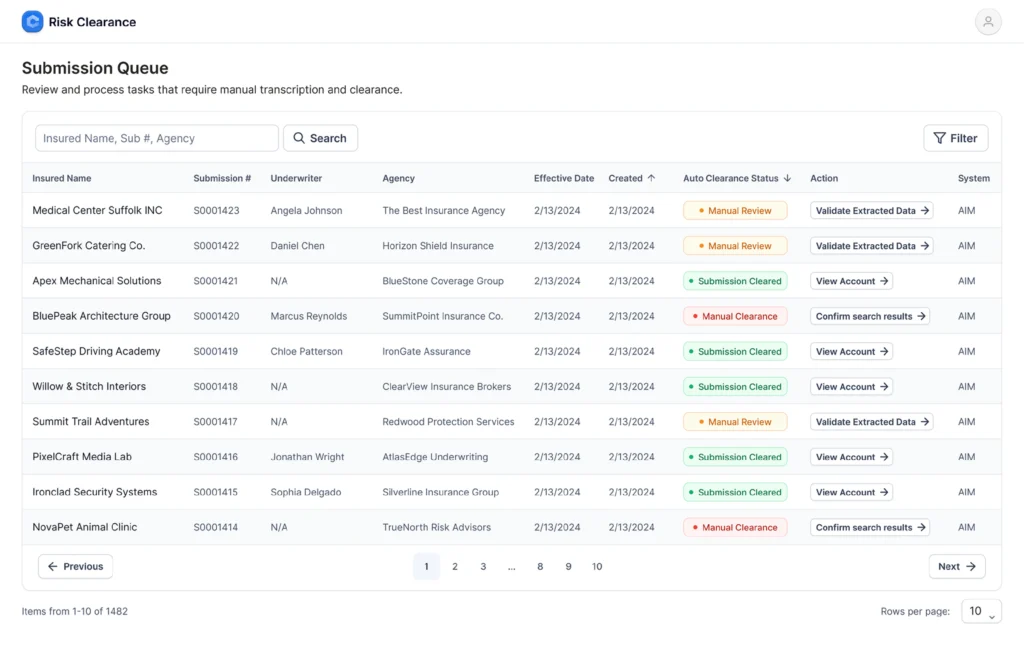

Manage Every Policy Step in

One Command Center

No more bouncing between inboxes and spreadsheets.

Bound AI gives you a single platform to validate data,

flag missing fields, and collaborate with retail and carrier

partners in real time. Everything’s in one place – from

intake to bind – clean, and fast.

Plug Into Your

Core Systems

As a trusted partner of Insurity, we have built Bound AI to integrate with their industry-leading platforms, including Sure MGA and ClaimsXpress.

Bound AI integrates directly with your AMS, PAS, accounting tools, and claims systems.

APIs keep data flowing smoothly – no silos, no rework – just operational clarity from first to final touch

Concierge Approach, Ensuring Smooth Integration

Our team works alongside yours to integrate Bound AI into your workflows, drive internal adoption, and unlock efficiencies at every stage of growth. As your business scales, we continue to optimize and deliver measurable,

lasting results.

Bound AI was built differently

Trusted by Forward-Thinking Producers Who Move Fast

The specialty market doesn't run on clean data and simple forms.

Submissions are messy. Risks are complex. And most insurtech providers miss the mark because they don’t understand the business behind the binder.

Born from over a decade of experience in specialty lines, we designed it to handle the mess, bringing speed and accuracy to the front of the process so your producers can focus on what matters most – underwriting judgment.

FAQ

Got questions?

We have the answers.

1. What types of insurance documents can Bound AI process?

Bound AI handles a wide range of insurance documents, including submissions, ACORD forms, loss runs, policy endorsements, FNOL (First Notice of Loss), SOVs (Statements of Values), handwritten forms, scanned images, and even low-quality or skewed documents. Our advanced AI ensures accurate extraction and classification regardless of format or quality.

2. How accurate is Bound AI, especially with handwritten or poor-quality documents?

Bound AI achieves an accuracy rate exceeding 99%, even when processing handwritten or degraded-quality documents. Our specialized AI models, including proprietary OCR and advanced machine learning algorithms, continuously improve by learning from each new document set to ensure reliable, precise results.

3. Can Bound AI integrate with our existing legacy systems?

Yes, Bound AI is designed specifically for seamless integration, whether you use modern cloud platforms or legacy systems. We offer flexible API-based integrations, RPA overlays, and customized middleware solutions that standardize extracted data to align perfectly with your existing infrastructure, ensuring minimal disruption.

4. Is our data secure when processed by Bound AI?

Absolutely. Bound AI prioritizes data privacy and compliance. Our solution operates within your own private cloud environment, ensuring data never leaves your servers. Bound AI adheres strictly to industry standards such as ISO 27001 and SOC II, utilizes robust encryption, and includes strict access controls and monitoring, safeguarding your sensitive information at every stage.

5. Does Bound AI completely replace human oversight, or do we still need manual reviews?

Bound AI automates 90–95% of standard extraction tasks, significantly reducing manual workloads. However, for complex cases or unique scenarios, it incorporates an expert-in-the-loop approach, allowing your own staff or Bound AI’s insurance experts to validate results in real time, ensuring high-quality output and compliance without compromising efficiency.