Home » Submission Intake & Clearance

Bound AI was explicitly built for the chaos of specialty insurance – messy documents, complex risk profiles, and

high-stakes timelines. Unlike generic AI platforms, Bound AI handles real-world inputs like SOVs, loss runs, and

ACORDs with the precision your team needs to quote faster and bind smarter.

Speed is also a huge factor: insurers that respond first are up to 40% more likely to bind.

(McKinsey)

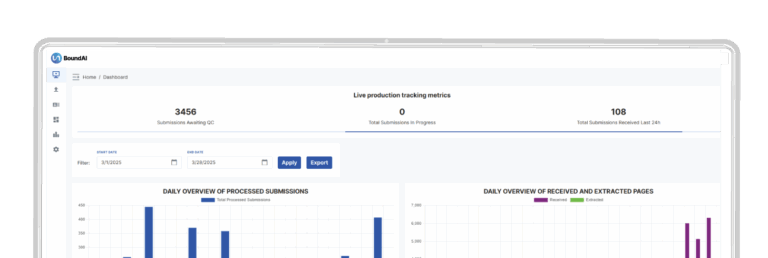

Bound AI transforms submission intake from a manual bottleneck into a fast, intelligent, and automated process.

Our platform extracts and validates submission data in real-time, flags incomplete or ineligible risks, and routes

the right submissions into your workflow so your underwriters can focus on writing, not chasing data.

Automatically extract key data from

emails, PDFs, and spreadsheets.

Applies your underwriting rules to

check for eligibility and completeness.

Directs submissions to the right

workflows or declines them instantly

if out of appetite.

Captures enriched data to

support portfolio analysis and risk

segmentation.

During peak renewal season, one national MGA used Bound AI to triage over 8,000 submissions in two weeks,

responding to brokers up to 5x faster than before and increasing their bind rate by nearly 50% in key programs.

“Bound AI enabled our underwriting team to consistently respond first to brokers, substantially improving our bind

ratio and significantly growing our market reputation.” – VP of Underwriting, Leading MGA

© 2025 All Rights Reserved.