When policy issuance breaks down, it doesn’t just slow your business. It bleeds it.

Delays frustrate brokers, strain underwriters, and shake client confidence. Errors lead to rework, compliance headaches, and even E&O exposure. And when things pile up? Deals get stuck. People get blamed. Growth stalls.

The irony? These issues usually have nothing to do with underwriting skill or decision-making. They stem from how information moves, or doesn’t, between systems, documents, and people.

If you’re still relying on fragmented workflows, manual data entry, or static PDFs, you’re not just inefficient. You’re at risk.

But there’s a better way – one that’s faster, smarter, and ready to scale.

TL;DR

Manual policy issuance isn’t a workflow problem. It’s a business risk hiding in plain sight.

In this article, you’ll learn:

- Why slow policy issuance is usually caused by data chaos and intake friction

- How smart automation cuts turnaround time without adding headcount

- Why Bound AI helps underwriters focus on decisions, not documents

- How operational design, done right, builds speed, accuracy, and compliance

- What a high-performing policy flow actually looks like in practice

- How real scale comes from letting your systems do the grunt work

The future of policy issuance is fast, structured, and audit-ready. And it’s already here.

What’s Broken Today

The problem with policy issuance isn’t just that it’s slow. It’s that it’s slow by design.

Most insurance operations are still built around fragmented tools and outdated workflows. Policy data is spread across emails, PDFs, spreadsheets, portals, and core systems, none of which talk to each other cleanly. That means every quote, binder, and policy involves some version of this:

- A broker submits a PDF submission with attachments.

- An underwriter or assistant manually extracts data.

- Someone keys the same data into multiple systems – rating, compliance, policy admin.

- A checklist gets passed around by email to confirm it’s “good to bind.”

- Eventually, someone creates the policy doc and sends it to the broker… if nothing breaks along the way.

It’s inefficient and error-prone by nature. Every manual touchpoint is a chance to miss something: a mismatched limit, an unchecked exclusion, a wrong effective date. And when that happens, it doesn’t just cost time. It can trigger regulatory red flags, claim disputes, or even lawsuits.

Worse, these errors often surface after binding, when fixing them is messy, public, and expensive.

Even teams that “handle the volume” are doing so by throwing people at the problem, doubling headcount instead of solving the root issue. That’s not scale. It’s controlled chaos.

The result? Longer turnaround times. Higher loss adjustment costs. Frustrated partners. Lost renewals.

This is the status quo. And it’s not sustainable.

What Good Looks Like

Fast, accurate policy issuance isn’t a dream scenario. It’s a byproduct of operational design.

In a well-run system, data doesn’t bounce from person to person. It flows cleanly, quickly, and with checks at every step. No redundant entry, email scavenger hunts, or second-guessing whether the binder matches the quote.

Here’s how that looks in practice:

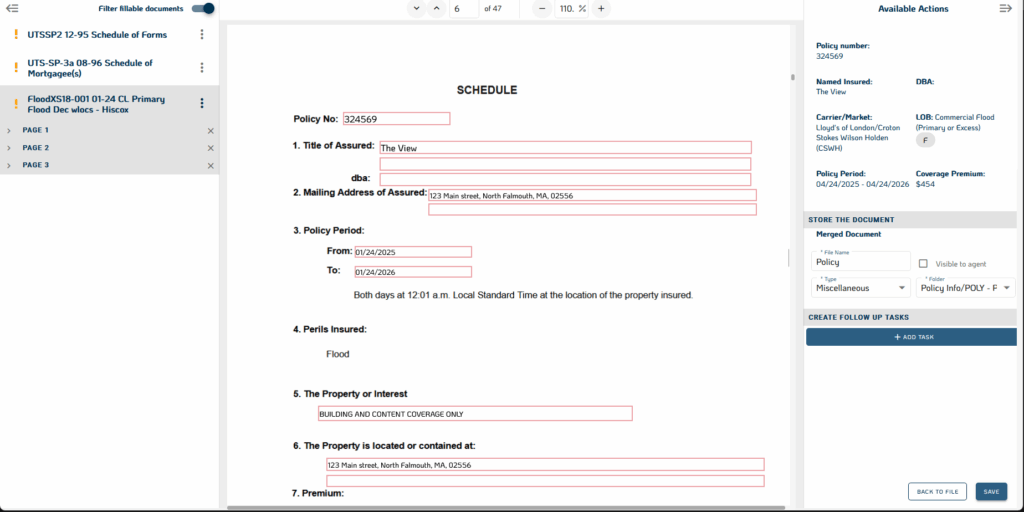

A broker sends in a submission. Within seconds, data is automatically extracted, validated, and mapped to your system of record. Missing fields trigger a prompt, not a backlog. Underwriters can immediately review risk details, quote, and bind, without lifting data from documents or rekeying into multiple systems.

Once approved, the system assembles the policy documents using structured data and templated logic. No waiting. No formatting errors. Just a ready-to-go packet that reflects exactly what was quoted and bound.

Every step is traceable, documents are audit-ready, and records match across systems.

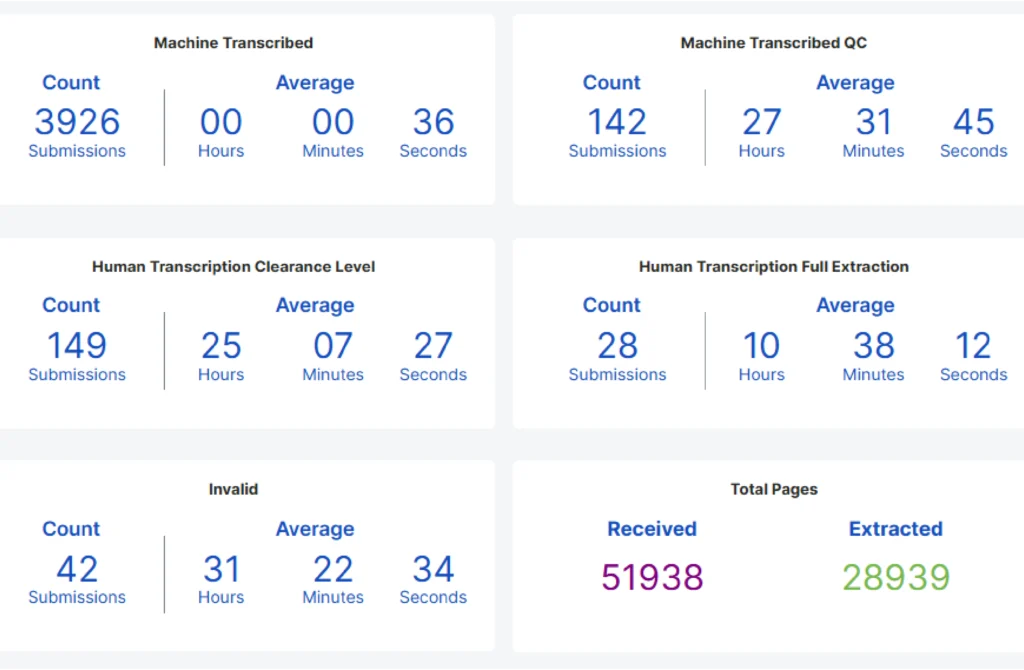

This is cleaner and faster. A process that used to take two to three days can be done in under two hours. Not because people are working harder, but because the system is doing the heavy lifting.

It’s also more reliable. No more second-guessing what’s in the policy jacket. No more late-night reissues. And no more discovering, weeks later, that the wrong limit made it into the system and is now unfixable without a full endorsement.

Most importantly, this kind of process gives your team room to think. To underwrite. To serve clients. And to grow without hiring 10 more people just to keep up.

That’s what good looks like. It’s not theoretical. It’s operational maturity, and it’s achievable now.

Meet Bound AI

Getting to that ideal state – the fast, clean, scalable version of policy issuance – doesn’t happen with more spreadsheets or another checkbox in your workflow. It happens when you rewire the foundation. That’s where Bound AI comes in.

Bound AI was built specifically for insurance operations by people who understand where the work breaks down. It doesn’t replace your policy admin system. It enables it to work smarter by aligning with the flow of intake, validation, and decision-making.

Here’s what it does, in plain terms:

- When a submission arrives, whether it’s a PDF, email, or portal export, Bound AI reads it, extracts the key data, and maps it to your system fields instantly.

- It flags missing or inconsistent information, so your team sees what’s incomplete before they start quoting.

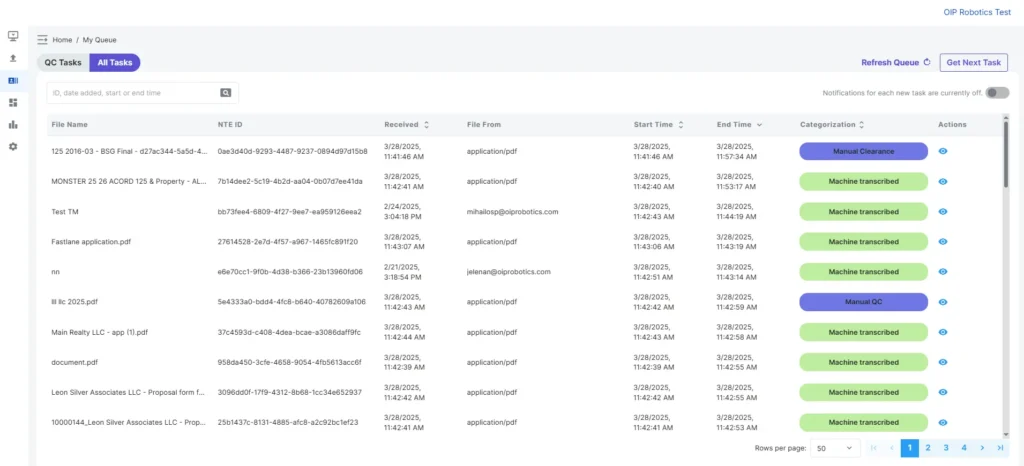

- It auto-generates tasks, triggers, and even pre-filled documents, so underwriters don’t waste time doing clerical work.

- Every action is logged. Every field is tracked. Every decision is explainable.

This isn’t some vague automation promise. It’s a practical tool that eliminates redundant work, enforces consistency, and reduces risk at scale. And because it was designed for specialty and commercial lines, it doesn’t choke when documents vary by line, broker, or program.

The result? Policy issuance moves faster, requires fewer people, and produces fewer errors. Underwriters spend their time on decisions, not on detective work. And operations leaders stop fighting fires long enough to plan for growth.

You can keep issuing policies the old way. Or you can let your system do it, at a speed and accuracy level that’s simply not possible with people alone.

Five Critical Ways Bound AI Wins

1. Eliminates Intake Bottlenecks

The most overlooked slowdown in policy issuance starts right at the beginning: intake. Submissions arrive in every shape and format – emails with PDFs, spreadsheets, scanned applications – and someone has to make sense of them. Usually, that someone is a junior team member manually copying and pasting data into systems they barely understand.

Bound AI kills that bottleneck.

It reads the document, understands the context, and extracts the exact data points needed – insured name, limits, dates, coverages, forms – then pipes that data directly into your systems. No toggling, no double-checking, no wasted mornings deciphering a broker’s formatting. Submissions move straight to underwriting, and nothing gets lost in translation.

2. Catches Errors Before They Cost Yo

Most policy mistakes don’t start as bad decisions. They start as bad data. A transposed number. A missed endorsement. A typo that turns $1M into $10M in liability coverage.

Bound AI reduces those risks before they can snowball. Every extracted field is cross-checked for accuracy, consistency, and completeness. If something is missing, incorrect, or contradictory, it gets flagged automatically, so your team isn’t making decisions based on flawed inputs.

Instead of catching mistakes after the policy is bound (or worse, after a claim), you catch them when they’re still fixable.

3. Frees Underwriters from Grunt Work

Your underwriters weren’t hired to format policy documents or chase down missing data. But that’s what they’re stuck doing, hours a day.

Bound AI takes that off their plate. By handling data extraction, field mapping, and document prep, it gives underwriters clean, complete files, ready for review and decision-making.

That doesn’t just improve productivity. It improves decision quality. Underwriters with time to think write better business. They don’t burn out. And they stick around.

4. Builds Compliance into the Process

No one wants to discuss audits until they actually happen. Then it’s a scramble, checking folders, tracing decisions, trying to reconstruct how a policy got issued the way it did.

Bound AI makes compliance effortless. Every document, field, and action is logged automatically. You know who did what, when, and why, without having to dig through emails or recreate a trail.

That’s not just helpful in an audit. It’s peace of mind, baked into the process.

5. Lets You Scale Without Hiring Like Crazy

Most growing agencies or MGAs hit the same wall: more business = more headcount. But hiring dozens of ops staff just to keep up with policy volume isn’t a growth strategy. It’s a stopgap.

Bound AI breaks that pattern. By automating the most repetitive, error-prone tasks in policy issuance, it lets your existing team handle significantly more volume, with less stress and fewer mistakes.

That’s real scale. Not by adding bodies, but by multiplying the impact of the team you already have.

Setting Up for Success

Getting results like the ones above doesn’t happen by flipping a switch. It happens when you are deliberate about how you integrate automation into your operation and what you expect it to accomplish.

The first step is knowing where your process breaks. That’s usually not where people think. It’s not “we’re slow.” It’s why you’re slow. Where does information get stuck? What steps rely on tribal knowledge or workarounds? Who spends time cleaning up what should’ve been done right the first time?

Start there. Bound AI works best when it solves the real bottlenecks.

Next, set up a pilot. Pick a program or line of business with enough volume to matter, but not so complex that exceptions overwhelm the setup. Configure Bound AI to handle intake, extraction, validation, and routing, then compare the results against your current baseline.

But don’t just look at “faster.” Track what matters:

- Time from submission to bind.

- Number of manual touchpoints per policy.

- Data errors caught pre-bind.

- Headcount reallocated from intake tasks.

- Underwriter time spent on actual underwriting.

Within weeks, you’ll see whether the system is doing what it’s supposed to: not just automating steps, but upgrading the entire flow.

And finally, don’t wait for perfect integration. Bound AI is built to plug into what you already use – your policy admin, CRM, rating engine, or task management system. You don’t need a system overhaul. You need clarity about what’s slowing you down and the will to fix it.

Speed and accuracy aren’t goals. They’re outcomes of strong operational design. Bound AI helps you get there but only if you’re willing to rethink how the work should happen.

The Bottom Line

Policy issuance is either a growth engine or a liability. There’s no in-between.

If your team is still spending hours moving data between PDFs, spreadsheets, and core systems, you’re wasting time and risking errors, compliance failures, and missed opportunities. The cost isn’t theoretical. It shows up in lost renewals, delayed revenue, and burnt-out teams.

The good news? You don’t need to rebuild everything to fix it. You need the right infrastructure to handle the heavy, manual parts of the process so your people can focus on work that actually moves the business.

Bound AI doesn’t just speed up policy issuance. It rewires it for accuracy, scale, and control.

And that’s what real operational maturity looks like.

The biggest reason is manual data handling. Most teams rely on people to extract, enter, and verify data from unstructured documents like PDFs and emails. Every handoff introduces delays and errors. Without automation at the intake and validation stage, policy issuance is slow by default.

Automation reduces errors by eliminating manual data re-entry and enforcing validation rules up front. When tools like Bound AI extract and check data against business logic before a policy is bound, mistakes are caught early, preventing downstream corrections and compliance issues.

Start by automating intake. If your team spends hours sorting and rekeying data from submissions, that’s the first place to focus. Automating that step alone cuts turnaround time dramatically, improves accuracy, and frees your staff for actual underwriting work.