Underwriting organizations rely on modern tooling to reduce friction and operate faster. On the other hand, many insurance companies still struggle with the same barrier: people’s resistance to change.

Underwriters already have a lot on their plate and feel the pressure of deadlines, calculations, discrepancies, compliance, etc. When new tools or workflows enter the picture, even the best teams can hesitate.

Digital adoption in underwriting fails when leaders underestimate this resistance or rush the rollout. It succeeds when the organization treats change like a managed, measurable, cultural process built on training, clear expectations, and continuous reinforcement.

This article breaks down how underwriting teams can overcome change resistance and adopt digital tools effectively, with tactical guidance you can use immediately.

TL;DR

- Underwriters resist digital tools when change feels disruptive, unclear, or rushed.

- Digital adoption must be treated as a guided operational shift rather than a software rollout.

- Adoption succeeds when teams move through phased implementation, clear communication, and training rooted in real underwriting work.

- Cultural buy-in matters more than technology.

- Measuring adoption keeps transformation grounded in outcomes, not assumptions.

- Bound AI accelerates digital adoption with underwriting automation, structured onboarding, and hands-on change management support.

Why Underwriting Teams Resist Digital Adoption

Underwriters work in high-stakes environments with tight deadlines and significant responsibility. Any disruption risks slowing down decisions or introducing uncertainty, and teams naturally resist anything that feels experimental or unclear.

Imagine working in the same system for 20 years, and all of a sudden you have to change your routine. On the other hand, underwriting is behind in software and technology compared to other industries, and changes are necessary.

Underwriters often worry that new tools will complicate workflows or add extra steps. Some fear technology may override their expertise or diminish their judgment. Others hesitate because they simply don’t have time to learn something new during peak workload periods.

The management shouldn’t treat underwriters’ resistance as a rejection of technology, because it’s actually a form of risk management. Underwriters protect their ability to work efficiently, and if digital adoption seems unpredictable, they will default to the methods they trust.

Digital transformation only succeeds when insurance organizations understand these concerns and build digital adoption plans that directly address them.

Building a Rollout Framework That Actually Works

A rollout fails when organizations treat digital adoption as a software launch instead of a managed operational shift. Underwriters need clarity, predictability, and visible support.

To avoid resistance, the rollout should guide teams through clear phases, set expectations they can trust, and show immediate value before expanding the scope. When the rollout feels intentional rather than intrusive, underwriters engage with the new system rather than resist it.

Start Slowly

Digital adoption in underwriting fails when teams attempt to change everything at once, and the team naturally resists that action. A successful rollout begins with a narrow, high-value use case that aligns with current behavior. Underwriters should see immediate benefits and have time to adapt, not theoretical improvements.

Create Controlled Phases

Once the first workflow stabilizes, the management should introduce the next phase. Underwriters need time to adapt, build confidence, and trust the system. A phased rollout provides predictability, clarity, and momentum.

Communication

Teams adopt tools more easily when they understand why the change exists, what problems it solves, and how it reduces friction. A structured rollout transforms adoption from a disruption into a guided experience.

Training Tricks

Underwriters embrace new technology when they understand it, trust it, and feel capable of using it. Even with the best technology and tools, there is a risk of resistance if the change is forced and sudden.

Training determines whether that happens. The first impression is essential and leaves a lasting impact on the further development of the underwriters’ opinion. Many organizations overwhelm their teams with long, generic sessions that feel disconnected from the real work of underwriting.

In contrast, effective training gives underwriters practical, hands-on experience with the exact scenarios they handle every day, gradually building confidence rather than flooding underwriting teams with information.

Real Underwriting Work

Generic demos are useless; underwriters want real-life examples on actual tasks. They need to see the action with actual submissions, quotes, binders, policies, endorsements, and actual documents. Training should feel like today’s work, not an ideal hypothetical situation that never happens.

Practical Training Sessions

As underwriters encounter new scenarios and complex accounts, they need rapid support and guidance. Training should deliver immediate skills and understanding. Short, focused sessions prevent cognitive overload and allow underwriters to apply what they learn without feeling overwhelmed.

Provide Reinforcement After Launch

Digital adoption in underwriting rarely succeeds with just a single training. Everyone who has worked a day in underwriting knows that each case is different and needs special attention.

Reinforcement prevents frustration and resistance and keeps teams from reverting to old workflows. Training becomes a success factor when underwriters feel capable, not pressured.

Cultural Buy-In

Underwriting teams don’t adopt technology because the culture around them supports it. Tools only take hold when leaders champion them, peers use them consistently, and early successes become part of the team’s narrative.

When underwriters see the technology making their work easier, not harder, resistance fades naturally. Cultural buy-in turns digital adoption from a mandate into a shared belief that the new way of working is better for everyone.

Tracking & Feedback

Digital adoption in underwriting becomes meaningful when measurement reflects actual outcomes. Insurance companies evaluate success through improvements in speed, accuracy, and data quality.

Listen to your team’s feedback. They are the ones using the tool every day and having real experience with it. Feedback is only powerful if you take action on it and adapt the practice to your team as much as possible.

Monitor Results

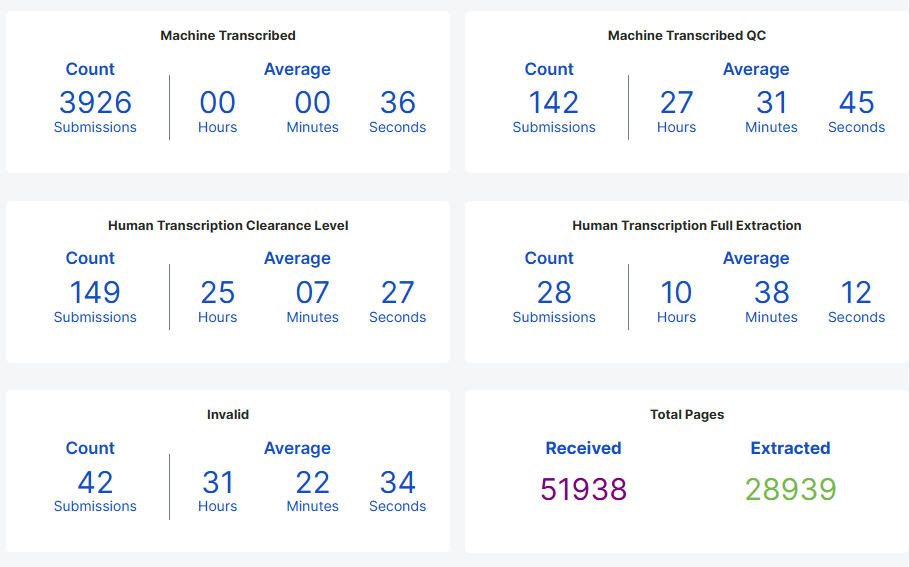

Teams should monitor turnaround times, submission volumes, data completeness, and the rate of manual rework. These indicators show whether the new system improves the underwriting lifecycle or exposes new friction points.

Measurement and Improvement

Metrics should guide optimization. The goal is continuous improvement, not policing. When measurement becomes collaborative, teams feel ownership of the transformation. Sustainable adoption grows from transparent results.

How to Measure Digital Adoption Success in Underwriting

Digital adoption becomes sustainable when organizations track impact with clear, measurable outcomes. Success metrics vary by business model, but underwriting teams commonly focus on improvements in:

- Turnaround times.

- Average time per task.

- Data accuracy and completeness.

- Reduced manual processing.

- Uptake and usage consistency.

- Error rates and rework.

- Operational leakage is tied to document handling or interpretation.

These metrics show whether underwriters use the tool, whether they use it properly, whether the workflow improves, and whether decision quality strengthens.

Measurement keeps expectations grounded in facts and ensures digital adoption produces real operational gains.

How Bound AI Helps Underwriting Teams Adopt Technology Faster

Bound AI supports underwriting organizations by providing industry-specific digital solutions, structured onboarding, change management expertise, and continuous operational guidance.

We created Bound AI based on real examples, and all our tech experts bring diverse underwriting experience. The platform integrates into underwriting workflows without disrupting established processes, giving teams immediate value rather than long learning curves.

Automation with Bound AI gives you improved accuracy, relieved underwriters, and the capacity to handle more workload. The result is faster rollout, stronger engagement, and smoother cultural adoption across the organization.

Check out our AI agents to find out more about their features and functions:

- Submission Triage Agent

- RiskClear Digital Worker

- Loss Run Analysis Agent

- SOV Processing Agent

- Policy Checking Agent

The Bottom Line

Digital adoption in underwriting is unavoidable, and it may succeed only when organizations treat change as a guided, measurable, supported process rather than a software installation.

Underwriters adopt new tools when they see clear value in them. Experiencing smooth rollouts, receiving practical training, and feeling cultural reinforcement from leadership rather than a bold order will bring more trust and confidence.

As underwriting grows more complex and data-driven, digital adoption becomes a competitive advantage. Keep in mind what Robin Sharma said:

“Change is hard at first, messy in the middle, and gorgeous at the end”.Begin your change now.