Most insurers don’t fail because of bad tech. They fail because the good tech they bought doesn’t talk to each other.

You can have the best CRM, a rock-solid policy admin system, a slick quoting engine, and an AI agent that extracts data in seconds, but if none of it connects, you’re still stuck in the same bottlenecks.

Disconnected insurance systems result in rekeyed data, duplicate work, missed insights, and automation that can only address surface-level issues. And as operations grow, so do the cracks. More policies, more submissions, more emails – piled on top of fragile workflows built on swivel-chair integrations.

If your tools aren’t integrated, you’re not scaling. You’re compounding inefficiency.

In this article, we’ll break down:

- The cost of disconnected insurance systems

- Why APIs are the backbone of modern insurance workflows

- The difference between automation around a problem vs. automation through it

- And how integration makes or breaks AI adoption at scale

Because if your systems aren’t built to talk, your operations will eventually break.

Book a Bound AI demo.

The Hidden Cost of Disconnected Insurance Systems

The average mid-sized insurer uses more than 15 different tools across underwriting, claims, and operations. Most don’t speak the same language. Many weren’t designed to.

That’s where the problems start, not in the tools themselves, but in the gaps between them.

Disconnected systems create drag

A submission enters your CRM but doesn’t sync with the policy admin system. So someone has to rekey the data. The claims notes live in one system, but the financials are stored elsewhere. Underwriters email loss runs to analysts, who upload them to a shared drive that no one audits.

Every handoff creates friction. Every system jump introduces risk.

- Decisions are delayed because the data isn’t centralized.

- Errors creep in through manual entry and version mismatches.

- Visibility disappears when different teams rely on different systems.

And all of it compounds over time. More clients, more data, more manual fixes.

Automation without integration is just patchwork

Many insurers try to solve this by layering automation on top. However, when those automations lack access to core systems, they become short-term fixes. You end up automating around the problems instead of solving them.

It’s like putting a faster engine in a car with flat tires. It might go a little faster, but it’s still going to break.

To scale operations and deploy AI intelligently, integration isn’t optional. It’s the foundation.

Why API Connectivity Is Non-Negotiable in Modern Insurance

APIs aren’t just a tech buzzword. They’re the invisible threads that hold your operations together and the only way to scale without breaking everything.

What’s an API, really?

An API (Application Programming Interface) is a digital translator. It allows two systems to talk to each other, share data, and trigger actions automatically.

Instead of manually copying data from your CRM to your PAS, an API does it in real time. Instead of downloading a file, renaming it, and reuploading it elsewhere, an API routes it instantly to the right system. It’s structured, secure, and seamless.

Why does this matter in insurance?

Because insurance isn’t one system but dozens. Quote engines, policy admin systems, document management platforms, CRMs, billing tools, and more. Without APIs connecting these, your workflows rely on humans as routers. That’s slow, risky, and expensive.

But here’s the real kicker: AI doesn’t work without APIs.

Whether it’s a Bound AI agent triaging submissions or checking policies for compliance, it needs access to systems where the data lives. No API means no access, and no access means no real automation.

If your systems don’t expose the right endpoints, your AI is flying blind. It can’t act, improve outcomes, and deliver ROI.

APIs are how you turn AI from a pilot into a platform. They’re infrastructure.

The Data Flow That Powers Scalable Automation

Automation only works as well as the data feeding it. If that data is trapped in inboxes, locked in PDFs, or siloed across disconnected insurance systems, your automation can’t do much more than slap band-aids on broken workflows.

To scale, insurance ops need clean, connected, continuous data flow. Let’s break it down.

Imagine a submission comes in by email. Without integration:

- Someone downloads the attachments

- Saves them to a shared folder

- Manually checks if anything is missing

- Forwards the email to underwriting

- Waits for someone to rekey the data into the PAS

That’s five manual steps before the file is even reviewed. Now picture that same process with integrated automation:

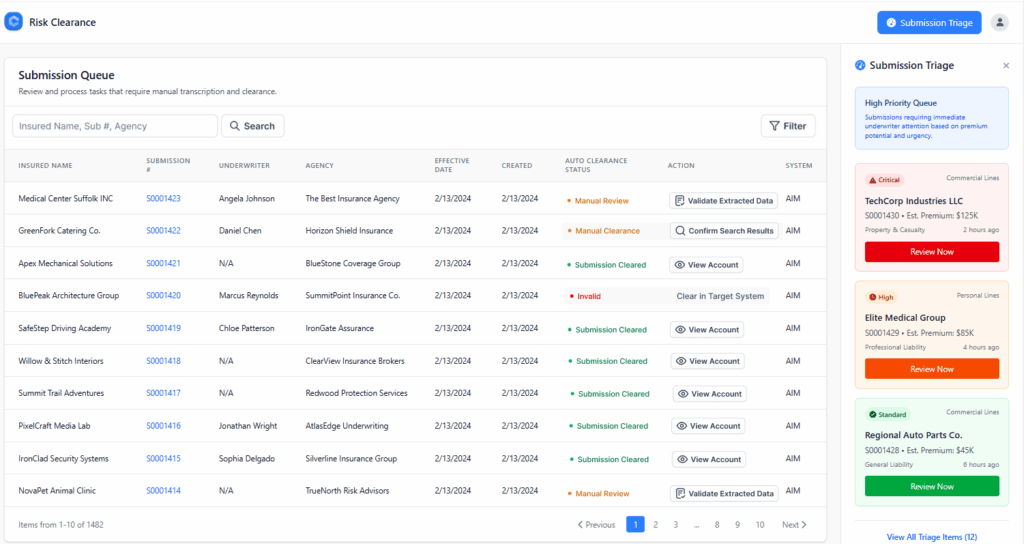

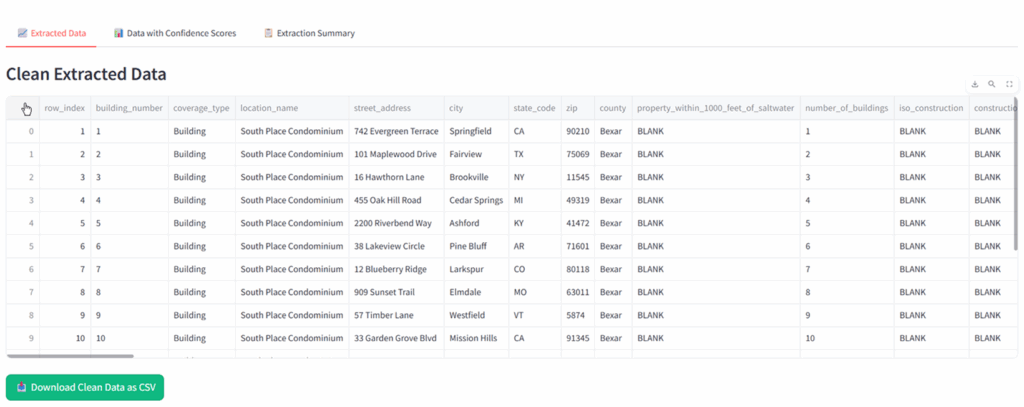

- The email triggers the Submission Triage Agent

- Files are ingested, labeled, and checked for completeness

- Missing items are flagged automatically

- Structured data is pushed directly into the PAS and CRM

- The underwriter sees a quote-ready file, already sorted by priority

That’s structural and fast automation at depth. And it only works because the systems are connected.

Why Bound AI agents depend on real-time data flow

Every Bound AI agent, whether it’s processing SOVs, checking policy language, or extracting loss runs, relies on automated access to documents, systems, and data fields. Not one-time access. Ongoing, real-time flow.

APIs make this possible. Without them, agents are stuck on the sidelines, waiting for humans to feed them files.

With them? They work like part of the team.

If your data isn’t moving, your automation isn’t scaling. Integration is what turns isolated tasks into continuous intelligence.

Integration Gone Wrong: Common Pitfalls (and How to Avoid Them)

Everyone says they want automation. But without solid integration, what most teams get is chaos in a new wrapper.

Here are the most common mistakes insurers make when trying to “modernize” and how to avoid them.

Mistake 1: Bolting on AI to Disconnected Insurance Systems

You buy a powerful AI tool, but it can’t access the data it needs. So your team ends up dragging and dropping files into the AI manually, treating it like a smarter spreadsheet, not an agent.

Without integration, even the smartest AI is just another silo.

Fix: Start with API access to core systems – PAS, DMS, CRM. If your AI can’t plug in, it can’t scale.

Mistake 2: Gluing Systems Together with Email and Excel

Some teams rely on spreadsheets and shared inboxes as the “middleware” between systems. But emails get buried. Files get misnamed. Versions get lost.

This kind of duct-tape integration creates more work, not less.

Fix: Replace email chains with structured pipelines. Use intake agents and process automation to route, label, and push data where it belongs.

Mistake 3: Inconsistent Data Models

One system uses “LOB,” another uses “Line of Business.” One tracks client names as “Smith, John,” while another tracks them as “John Smith.”

These mismatches break automation and cause silent failures.

Fix: Standardize field names, formats, and structures across systems. Invest in clean data before you invest in more tools.

Mistake 4: No Alignment Between Ops and IT

Ops teams want speed. IT teams want control.When they don’t align, you get stalled integrations, shadow tools, and unmet expectations.

Fix: Choose integration projects that serve both. Start with pilots that solve urgent ops pains and build IT-approved foundations that can scale.

The point isn’t to connect everything at once. It’s to integrate where it counts and build on wins from there.

Integration Best Practices: Building the Right Foundation

You don’t need a complete system overhaul to scale. You need the right connections in the right places, built for automation, not just access.

Here’s how forward-thinking insurers are laying the groundwork for AI-powered growth:

1. Adopt an API-First Strategy

If a system doesn’t have APIs, it won’t scale with you. Modern platforms (PAS, CRM, DMS) should expose secure APIs that let tools talk to each other directly, no middleware, no humans-in-the-loop.

What to look for: RESTful APIs, webhook support, secure authentication (OAuth2), clear documentation.

2. Design for Modularity and Interoperability

Don’t build a monolith. Build a system where components can evolve independently.

If your document ingestion process improves, it shouldn’t require overhauling your entire submission workflow. If you add a new Bound AI agent, it should plug into your data flow (not force a rebuild).

3. Standardize Data Across Systems

Different systems = different data vocabularies. That kills automation.

Establish consistent formats, naming conventions, and validation rules. Use shared schemas to keep data structured and usable across workflows.

4. Prioritize High-Impact Connections First

Not all integrations matter equally. Start with where your teams lose the most time and accuracy, usually:

- PAS ↔ Submission intake

- CRM ↔ Document management

- Email inboxes ↔ AI agents

Triage the integration work just like you’d triage underwriting tasks: what delivers ROI fast?

5. Build for Security, Monitoring, and Scale

Integration isn’t just about access, but also trust.

Make sure APIs are secured, usage is logged, and performance is monitored. Set thresholds and alerts. Build guardrails before building speed.

The Bottom Line

You can’t scale if your systems don’t talk. Disconnected insurance systems create drag, confusion, and risk. And the more you grow, the more those cracks widen.

Integration is no longer a technical decision but a strategic one.

If you want to automate underwriting workflows, reduce submission turnaround time, and give your team the tools to move faster with confidence, you need clean, connected infrastructure. That means APIs, standardized data, and partners who understand how insurance actually works.

Bound AI was built for this. Our AI agents are only as powerful as the systems they integrate with and we’ve made that integration seamless. No swivel-chair workarounds. No black-box magic.

Just real connections, real automation, and real results.

If your systems can’t talk, they can’t grow. Let’s fix that.

Book a Bound AI demo.