Quoting fast means everything for an MGA.

Markets are competitive. Brokers are impatient. And the submission that sits in your inbox too long? It’s already in someone else’s pipeline.

The MGA that quotes first often wins, even if they’re not the cheapest. But speed without structure leads to errors, rework, and compliance risk, and no one can afford that in this market.

That’s why forward-thinking MGAs are rebuilding around one clear goal: to build a workflow that quotes first, clean later, but never blindly.

With Bound AI, they’re not guessing. They’re using intelligent agents to structure submissions, analyze risk, and surface red flags automatically, so underwriters can quote with speed and confidence.

This article breaks down what that workflow looks like, what’s broken today, and how Bound AI helps MGAs move first and win more.

TL;DR

Quoting first is how MGAs win business, but most workflows aren’t built for speed or scale.

In this article, you’ll learn:

- Why traditional MGA workflows delay quoting and create bottlenecks

- What a quote-first workflow actually looks like in practice

- How Bound AI agents automate triage, loss run review, SOV processing, policy QA, and more

- What kind of results MGAs are seeing – faster quoting, fewer errors, and better underwriting focus

- Why speed without structure isn’t sustainable and how Bound AI fixes that

You won’t quote faster by working harder. You will quote smarter with a workflow that’s built for it.

Book a Bound AI demo.

Why Most MGA Workflows Are Built Backwards

Most MGA workflows weren’t built for speed but for control, at a time when volume was manageable and brokers were willing to wait.

That’s no longer the case.

Today, brokers expect quick turnaround, clean quotes, and fewer follow-ups. But most MGA teams still operate in a linear, manual process that looks something like this:

- Submissions arrive in a flood of emails, PDFs, spreadsheets, and attachments.

- Ops teams triage manually, sorting by line of business, region, or urgency.

- Underwriters wait until the submission is cleaned up, files are renamed, and documents are fully reviewed.

- Only then does quoting begin.

- QA and compliance checks? Often bolted on after the quote, or worse, after binding.

This backward flow creates friction at every stage:

- High-potential submissions get stuck behind incomplete ones.

- Loss run review eats up hours before a quote can even start.

- Errors are caught too late, leading to rework, awkward broker callbacks, or worse, compliance issues.

- Underwriters spend more time organizing files than making decisions.

And while some MGAs attempt to solve this by increasing headcount, that only adds complexity. More people, more handoffs, and more opportunities for something to break.

Bound AI turns that model on its head.

Instead of gating the quote behind admin work, it pushes that work into the background, handled by digital agents, so underwriters can move faster without losing control.

What a Quote-First Workflow Actually Looks Like

A quote-first workflow doesn’t mean cutting corners, but removing the bottlenecks between submission and decision.

When MGAs adopt this mindset, the goal shifts: Get the quote out fast but make sure it’s right. That means giving underwriters what they need, when they need itwithout making them dig, wait, or guess.

Here’s how that workflow plays out in practice:

1. Submission hits the inbox → Agent reads it instantly

Instead of waiting for someone to open the email and scan attachments, a digital agent triages it immediately. It checks for required documents, identifies the line of business, and flags whether it’s complete or needs follow-up.

2. Files are structured and analyzed in minutes

Loss runs? Parsed and summarized.

SOVs? Cleaned and validated.

Applications? Extracted and mapped to standard fields.

By the time an underwriter sees the file, it’s a decision-ready package instead of a total mess.

3. Underwriter quotes confidently and quickly

No one’s guessing at past losses or flipping between carrier formats. The data is clear. Red flags are surfaced. Quotes go out faster and with fewer errors.

4. Compliance is baked in, not bolted on

Policy Checking Agent reviews the quote against referral conditions and internal rules before binding, not after. Issues are caught early, not discovered during audits or renewals.

It’s a shift in how the work is structured, designed to deliver quotes faster, with less friction, and more control. And the teams that build this way? They’re winning business that used to get lost in the inbox.

How Bound AI Rewires the Workflow (By Use Case)

Bound AI automates tasks and rebuilds the flow of work so underwriters can quote faster with cleaner data, fewer delays, and total visibility.

Here’s how each AI agent plays a role in removing friction between submission and quote:

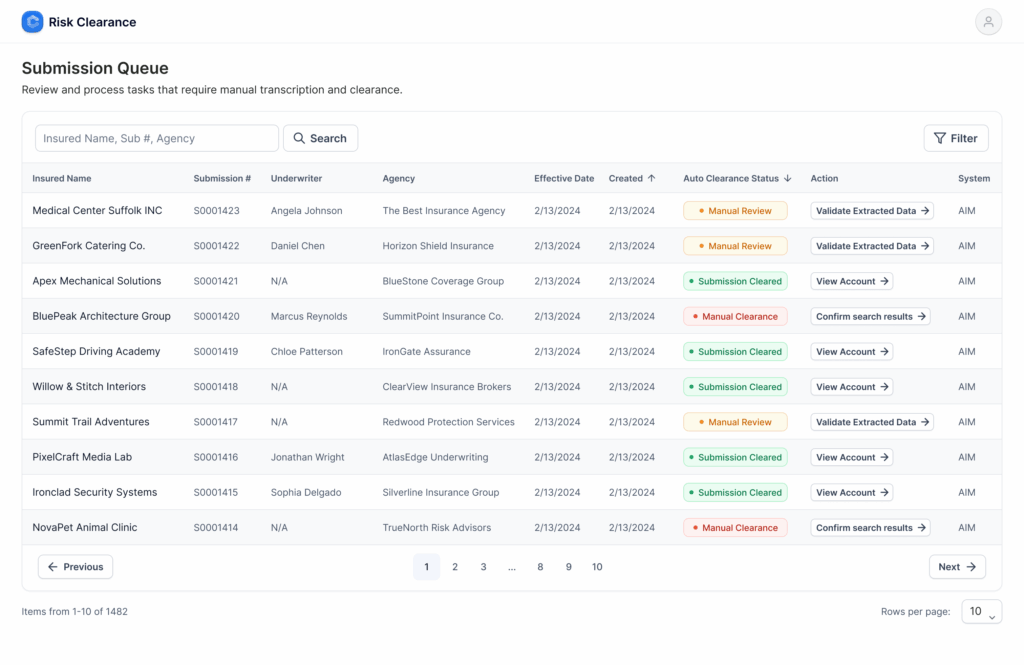

Submission Triage Agent

The moment a submission arrives, regardless of format, this agent steps in. It reads the attachments, identifies the line of business, checks for required documents, and flags whether the submission is complete.

It can even assign priority based on complexity or broker. No more first-in, first-out queues. High-quality deals rise to the top automatically.

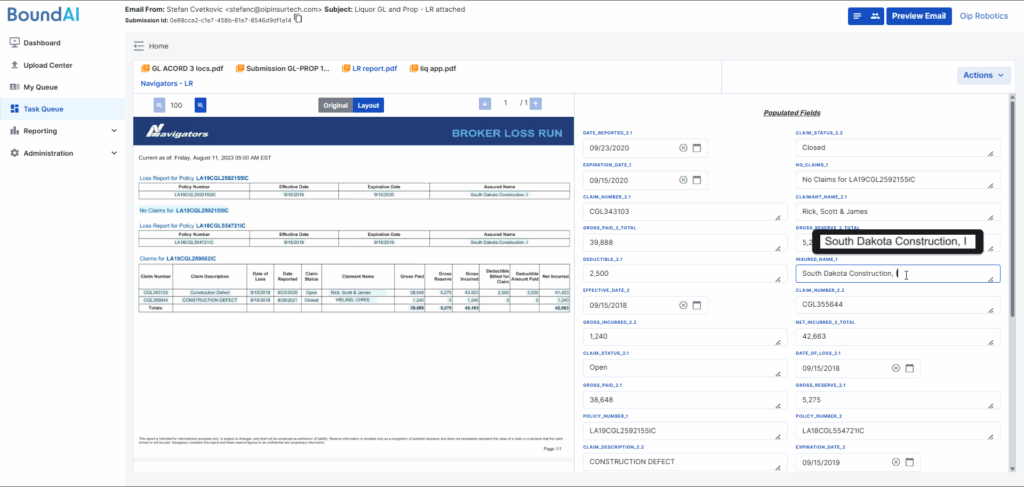

Loss Run Analysis Agent

Instead of spending 30+ minutes reviewing a loss run, underwriters get a summary in seconds. The agent extracts data from multi-carrier PDFs, normalizes it, flags potential issues (such as missing years or large open reserves), and delivers a clean, structured view.

Underwriters won’t waste time digging through tables. Instead, they will focus on risk evaluation and pricing.

SOV Processing Agent

Property schedules are often a mess, with wrong formats, missing values, and too many columns. This agent cleans, validates, and structures SOVs automatically.

It identifies incomplete rows, flags errors, and outputs a consistent file that’s ready for ingestion or modeling. Most importantly, the agent removes hours of back-and-forth before quoting can begin.

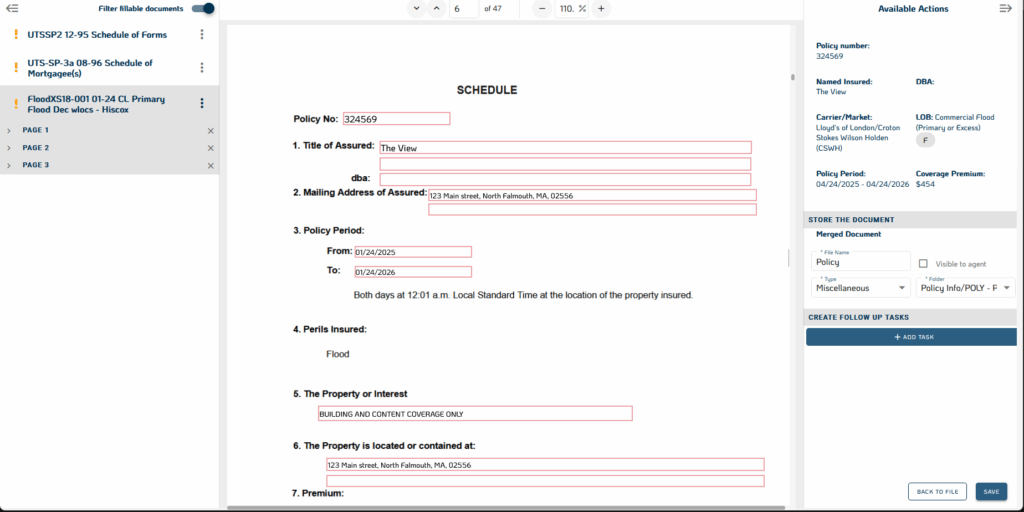

Policy Checking Agent

Before a quote turns into a bound policy, this agent checks for discrepancies between quoted terms and final documents. It compares limits, endorsements, and referral conditions to ensure nothing slips through.

Issues are flagged before they become rework or E&O exposure. It’s QA that happens before bind, not after someone gets burned.

RiskClear Digital Worker

This is the glue between data and decision. RiskClear pre-reads the submission package, identifies gaps, and surfaces key exposures.

It provides underwriters with a structured view of what matters most, without requiring them to dig. Think of it as the fastest way to get a second brain on every file.

The Results: Faster Quotes, Stronger Control

Bound AI changes what your team can do in a day.

MGAs using Bound AI agents are quoting faster, handling more volume, and tightening control over every step of the process, all without growing headcount.

Quoting time drops from days to hours

Submissions that used to sit untouched in the inbox now hit underwriters who have already been triaged and structured.

Instead of waiting for a loss run summary or SOV cleanup, underwriters move straight to pricing. Quotes are sent out the same day, often within the same hour.

Ops teams stop firefighting and start scaling

With agents handling intake, extraction, and pre-bind QA, operations leaders can shift their focus to optimization, rather than rescue.

No more “just get it out the door” under pressure. You get predictable, auditable workflows that can grow with your book.

Underwriters spend more time making decisions, not formatting files

When the busywork disappears, underwriting talent does what it’s best at: evaluating risk, shaping deals, and responding to brokers faster than the competition.

That’s how you win and keep top producers.

Fewer errors. Less rework. Zero surprises.

Because Bound AI catches discrepancies, flags red flags, and ensures policy accuracy before bind, your team avoids the painful (and costly) downstream corrections.

The work is cleaner. The output is more defensible. And the process actually holds up under audit.

The Bottom Line

Quoting fast is the difference between winning the deal and never getting a second look. But speed without structure is just risk disguised as efficiency.

Bound AI gives MGAs the infrastructure to move faster, without losing control. By automating intake, analysis, triage, and QA, you unlock a workflow that’s built to quote first, quote clean, and scale without chaos.

If your team is still waiting on formatted spreadsheets and manually reviewing loss runs, you’re already behind.

The MGAs quoting first aren’t lucky. They’re built differently.

Book a Bound AI demo.