Underwriting is heading into its most important transformation in decades. What was once treated as a slow, back-office function is becoming the core engine of profitable growth. Rising catastrophe losses, new types of risk, tighter regulation, and clients who expect answers now are exposing the limits of traditional underwriting models. Slow, manual, and siloed processes simply can’t keep up anymore.

The Underwriting Shift: Why 2030 Will Redefine the Industry

Three forces are converging at once. Volatility is rewriting pricing assumptions as climate-driven losses continue to rise. Complexity is reshaping risk profiles, with cyber, supply chain, and other emerging exposures demanding richer data and deeper expertise. Expectations are rising fast. Brokers and clients want real-time quotes, transparent terms, and a consistent experience across every interaction.

McKinsey projects that by 2030, most personal and small-business underwriting will be fully automated, with humans overseeing portfolios rather than rekeying documents. Complex commercial risks will still require judgment, but underwriters will rely on AI copilots, predictive analytics, and decision-support tools to move faster and make more confident decisions. The balance of work shifts away from admin and toward strategy, relationships, and higher-value analysis.

The business case is equally clear. Integrated underwriting workflows can unlock up to 40% productivity gains by automating intake, triage, extraction, and risk scoring. Document-heavy tasks (loss run analysis, SOV extraction, application review) can reduce costs by up to 50% when automated. Faster, more consistent decisions improve the submission-to-quote cycle, strengthen broker relationships, and reduce leakage across the portfolio.

The message is simple: underwriting is becoming a competitive differentiator. The firms that modernize now (connecting systems, automating manual steps, and empowering their teams with AI) will enter the next decade with a clear advantage. Those who wait will play catch-up in a market that won’t slow down for them.

The New Playbook for Carriers, MGAs, and Brokers

Underwriting transformation isn’t happening in one corner of the market. It’s reshaping the entire insurance ecosystem. MGAs, carriers, and brokers each face different pressures, but the path forward is the same: move faster, operate with discipline, and build technology-driven workflows that eliminate friction from every step of the underwriting cycle.

Carriers: Build Real-Time, Integrated Underwriting

Carriers can’t rely on spreadsheets, manual intake, or fragmented systems and expect to stay competitive. The next generation of high-performing carriers is already automating end-to-end workflows – submission intake, triage, document extraction, risk scoring, and quoting – all functioning as one connected process.

Automation isn’t replacing underwriters; it’s elevating them. AI surfaces red flags, validates information, pulls data from external sources (IoT, geospatial, climate), and supports decision quality. Underwriters focus on judgment, portfolio strategy, and client engagement. The shift toward prevention is also accelerating. Leading carriers are building products with real-time alerts, risk scoring, and behavior nudges, moving away from “respond after the loss” toward anticipating and preventing it.

The carriers winning in 2030 will be the ones building this infrastructure now.

MGAs: Combine Agility With Operational Discipline

MGAs are positioned to scale quickly, but only if their operations can keep up. The most successful MGAs will double down on specialization, owning emerging or underserved segments like cyber, climate, embedded insurance, and new commercial niches. Capacity providers want partners who understand nuance, process submissions cleanly, and keep loss ratios stable.

To do that, MGAs must treat data as an asset, not an afterthought. Extracting structured data from broker emails, loss runs, and SOVs allows them to build pricing feedback loops, predict loss ratios, and automate triage. Automation also helps MGAs scale without losing control—standardizing documentation, reducing errors, and mitigating audit risk.

Compliance becomes a growth driver. MGAs with clean files, automated checkpoints, and reliable SOPs win more authority and more capacity. The MGA of 2030 is still agile, but also disciplined, data-driven, and tech-enabled.

Brokers: Become the Tech-Enabled Risk Advisor

The broker role is evolving faster than any other. Clients expect speed, clarity, and proactive guidance. At the same time, carriers and MGAs are expanding their own digital capabilities, putting pressure on brokers to deliver more value.

By 2030, leading brokers will automate administrative tasks like certificate issuance, policy changes, loss run chasing, and submission processing. AI will pre-fill quote templates, summarize incoming documents, surface missing information, and identify risk trends across portfolios. With that time freed up, brokers can shift into true advisory roles—helping clients understand emerging risks, designing prevention programs, and using analytics to support decisions.

Brokers who connect to MGAs and carriers through APIs, standardized submissions, and real-time quote tracking will move faster and place business more effectively. Those who cling to manual workflows will fall behind.

The 2030 Readiness Test: Are You Actually Prepared?

Most insurers agree that underwriting needs to change. Far fewer know where they actually stand. The firms that win over the next five years won’t be the ones with the biggest budgets—they’ll be the ones with clarity. Clarity about what’s slowing them down, what’s costing them money, and what’s preventing their underwriters from operating at their best.

This section isn’t a checklist. It’s a stress test for your current operating model, one that reveals whether you’re truly ready for real-time, scalable underwriting or still relying on workflows that won’t survive the next decade.

1. Is your document intake still manual?

If PDFs are still being downloaded, renamed, and manually rekeyed into quoting systems, you’re already behind. Manual intake introduces delays, inconsistent triage, and unnecessary rework, especially when every submission has its own format, structure, and data gaps.

Real-time intake is no longer a future goal. Tools like Bound AI already extract data from loss runs, SOVs, and applications with over 99% accuracy, turning hours of manual work into minutes. If you don’t know what percentage of your inbound volume is still handled manually, that’s your first signal something’s off.

2. Are you augmenting your underwriters with AI?

The question isn’t whether AI will replace underwriters. It won’t. The real question is whether you’re using AI to support them.

Carriers should use rules engines, data validation, and triage logic to reduce noise. MGAs should ensure submissions are screened for fit, appetite, and profitability before an underwriter ever touches them. Brokers should equip producers with tools that pull structured data from messy PDFs and highlight coverage gaps.

Companies already using AI copilots are seeing material gains: faster time-to-quote, fewer back-and-forth emails, and significantly less downstream cleanup. If your people spend more time preparing data than analyzing it, you’re not ready for 2030.

3. Can your systems connect, scale, and support real-time data flow?

If underwriting hinges on emails, disconnected platforms, and Excel spreadsheets, scaling will eventually break your process.

Ask yourself:

- Can your intake system automatically ingest structured data from brokers?

- Can you submit data to carriers, reinsurers, or partners through APIs?

- Do you have real-time dashboards tracking cycle times, declines, bind ratios, and bottlenecks?

According to McKinsey, firms that digitize end-to-end will outperform those with fragmented systems by up to 30% in operating margin. If your infrastructure can’t grow with you, it’s already slowing you down.

4. Are your decisions explainable and audit-ready?

As AI becomes a fixture in underwriting, explainability becomes non-negotiable. Regulators want clarity: how was a decision made, what data was used, and can it be reconstructed?

If you can’t trace how a quote was generated or why something was declined, you’re exposed.

Building auditability now reduces risk later. It also makes delegated authority programs stronger, keeps MGAs compliant, and ensures broker recommendations are defensible.

5. Are you future-proofing your team?

Aging underwriting talent, shrinking back-office pipelines, and rising complexity mean insurance talent gaps will widen. The organizations that thrive in 2030 are already training their teams to work with AI tools, building SOPs for every key workflow, and using flexible staffing models to support peaks in volume.

This isn’t about replacing people but redeploying them to where they make the greatest impact – risk evaluation, client relationships, and portfolio strategy.

If you answered “no“ to any of these questions, you’re not alone, but you’re also not ready.

The readiness test reveals the gaps. The next section shows how to close them with practical, insurance-native AI that fits into real underwriting workflows.

Building the Future: How Bound AI Enables Real-Time, Scalable Underwriting

Most AI tools promise efficiency. Very few deliver it in the messy, document-heavy, compliance-driven world of underwriting. That’s why generic automation platforms struggle in insurance. They weren’t built for broker submissions, inconsistent PDFs, shifting appetites, or delegated authority requirements.

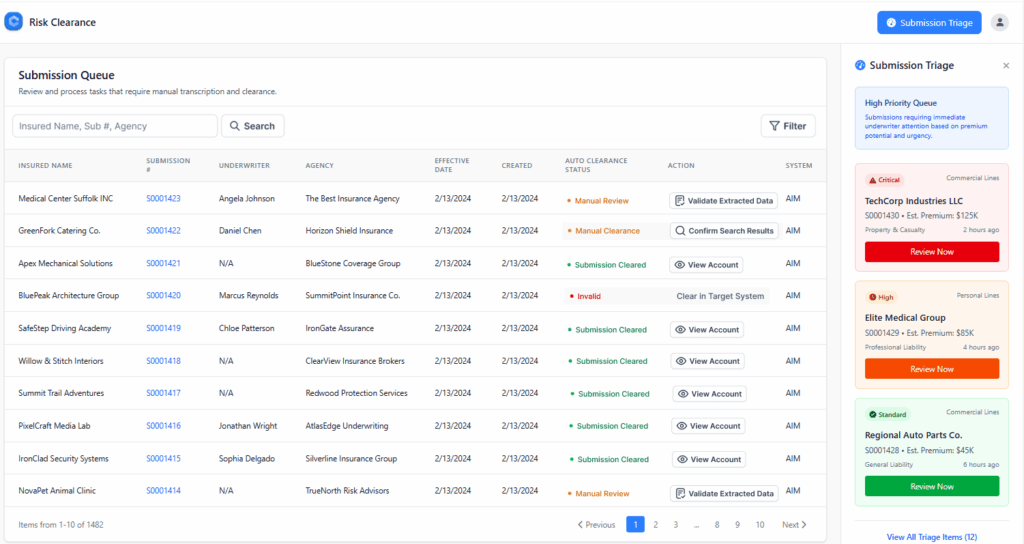

Bound AI takes a different approach. It was built by insurance professionals who understand how underwriting actually works, where workflows break, and what underwriters need to make faster, more confident decisions. Instead of forcing you into a new system, it fits directly into your existing ecosystem and removes the manual work that slows everything down.

AI Agents Built for Underwriting

Bound AI uses modular agents trained specifically on insurance documents – loss runs, SOVs, apps, endorsements, broker emails, and more. These agents can automatically extract data, classify submissions, summarize risk, and prepare information for the next step in your workflow.

Because they’re modular, you can deploy them one at a time:

No massive implementation. No replacing legacy systems. Just targeted automation that starts driving value immediately.

Clients already see 99%+ extraction accuracy, eliminating the hours typically spent reviewing PDFs, reconciling fields, or cleaning data before a quote can be generated.

Proven Outcomes Across the Industry

Bound AI isn’t theoretical. It’s already deployed across carriers, MGAs, and brokers who need to move faster without sacrificing control. These teams report:

- 65% reduction in processing costs

- 99%+ document extraction accuracy

- Minutes, not hours, to review submissions

- Higher quote-to-bind ratios due to better triage and faster turnaround

- Reduced audit findings thanks to clean, consistent documentation

Whether you need a human-in-the-loop model or fully autonomous workflows, Bound AI adapts to your operating strategy. Some clients use it only for pre-underwriting preparation. Others automate entire quote packages for specific lines or binders.

Execution Is Everything and the Time Is Now

Underwriting leaders know where the market is heading: cleaner data, faster cycles, consistent decisioning, and more intelligent workflows. The gap between firms acting today and those waiting for “the right moment” will grow wider over the next five years.

Bound AI gives insurers a practical way to modernize now, without rebuilding their entire tech stack or overwhelming their teams.

The underwriting leaders of 2030 are already using AI copilots, embedded prevention tools, and real-time data infrastructure. Bound AI is helping them get there faster, with less friction, and with measurable results from day one.

If you’re serious about shaping the future of underwriting, it starts with transforming the work that slows you down today. Bound AI is built for exactly that.