If you’re leading underwriting, operations, or transformation inside an insurance firm right now, you’re probably feeling it.

The board wants AI. Your competitors are making announcements. Vendors are flooding your inbox with “game-changing” solutions.

But behind the noise, one question keeps surfacing: What exactly should we do with AI, and how do we do it without breaking what already works?

For many, the concept of Agentic AI adds another layer of confusion. It sounds technical. Abstract. Maybe even overhyped.

And yet, it’s quietly becoming the foundation for real automation inside some of the most forward-thinking insurance organizations today.

This article is designed to cut through the confusion. You’ll learn what Agentic AI for insurance actually is (in plain terms), how it’s already being used across underwriting and ops, and what questions you need to be asking if you’re serious about modernizing your workflows without compromising performance, compliance, or control.

If you’re trying to lead your team forward but don’t want to fall for the next shiny object, start here.

TL;DR

Agentic AI is already reshaping how insurance teams work, far beyond generative chatbots or pilot projects.

In this article, you’ll learn:

- What Agentic AI is (and how it’s different from generative or rules-based tech)

- Where it solves real problems in underwriting and operations, right now

- How leading firms are already deploying agents to eliminate bottlenecks

- Why doing nothing means compounding costs, talent churn, and rework

- How to evaluate AI partners that actually understand insurance

- What Bound AI agents are doing today, from triage to policy checking to risk analysis

The industry’s moving. You don’t need a moonshot. You need a starting point.

What Is Agentic AI and Why It’s Already Defining the Future of Insurance

Agentic AI isn’t another buzzword. It’s a practical shift in how AI is applied. Unlike generative AI, which creates content (text, images, summaries), or predictive AI, which forecasts based on data patterns, Agentic AI takes action toward a defined goal.

These are AI systems designed to analyze, generate, and act. Agents that receive an input (like a loss run or a submission) make decisions based on rules and data and complete a workflow with minimal human intervention.

How is that different from rule-based automation?

Rules-based automation follows rigid scripts. It breaks as soon as reality deviates from what was expected, which, in insurance, is always. No two PDFs look the same. No two brokers submit in the same way. And there are no two accounts that follow a standard playbook.

Agentic AI is built for that variability. It uses a combination of language models, workflow logic, and task-level decision-making to flex with the work and repeat it.

Plus, it doesn’t need a template for every carrier or require reconfiguration every time a field name changes. It learns, adapts, and improves.

Why insurance is the perfect fit

The insurance industry is drowning in workflows that are:

- Document-heavy

- Multi-step

- Slightly different every time

- Filled with checks, approvals, and handoffs

Manual workarounds and human bottlenecks are everywhere – from intake to triage, QA to compliance. Despite numerous attempts to streamline processes with traditional automation, most carriers and MGAs continue to rely on email threads, spreadsheets, and copy-paste tasks to complete their work.

This is where Agentic AI thrives. It doesn’t try to replace the underwriter or the claims adjuster. It replaces the wasted time between decisions, the part that slows everything down and introduces risk.

And if you ignore it?

Then you’re falling behind and building operational debt.

The cost of doing nothing adds up:

- Turnaround times stay slow while competitors move faster

- Headcount grows to keep up with volume, but the margin doesn’t

- Your best people le

- ave because they’re stuck doing low-leverage work

- Audits get harder, errors slip through, and rework becomes standard

Agentic AI isn’t about chasing a trend. It’s about future-proofing how your business runs before someone else does it better.

Where Can Agentic AI Have the Most Impact in Underwriting and Ops?

Agentic AI for insurance is purpose-built for the kind of messy, high-friction work that dominates the industry. If you’re leading underwriting or operational strategy, here’s where it can immediately move the needle:

1. Submission triage

Triage sounds simple until you’re buried in hundreds of submissions per week, each with different formats, attachments, and missing data. Today, teams manually open PDFs, check for completeness, and prioritize based on gut feel, availability, or whoever yelled the loudest.

Agentic AI flips that. It reads every submission as it comes in, evaluates completeness, urgency, and relevance, and routes it accordingly without waiting for a human to sort the queue.

Faster intake = faster quoting = more won business.

2. Document intake and data extraction

Loss runs, SOVs, apps, broker emails – they’re all rich with data, but none of it is structured. Humans alone spend hours copying info from one system to another just to get to the starting line. Mistakes happen. Deadlines slip. Underwriters burn out doing clerical work.

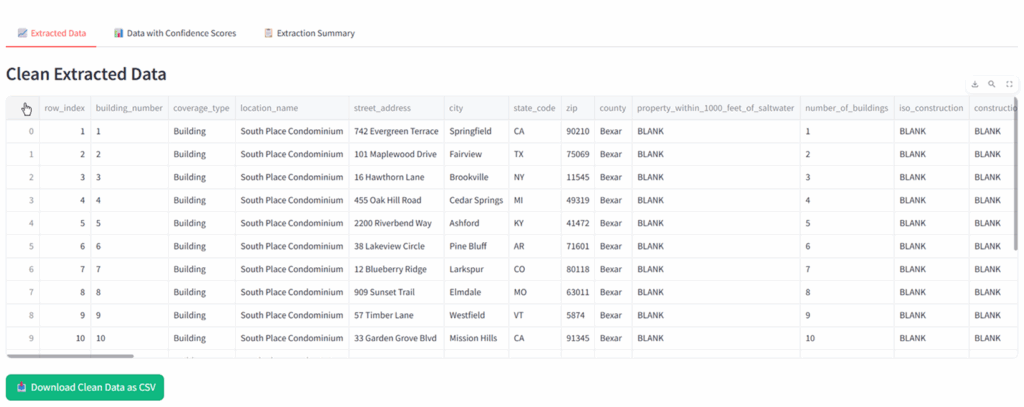

Agentic AI can instantly extract structured data from unstructured files, regardless of carrier format, and feed it directly into your core systems. It’s intelligent processing with accuracy, context, and audit trails.

3. Pre-bind QA and policy checking

Before a policy goes out the door, it needs to be right. That means checking it against the quote, endorsements, and compliance rules, often line by line.

Agentic AI handles that with speed and precision. It can compare quoted terms to bound documents, flag discrepancies, and even draft QA reports automatically. What used to take an hour now takes minutes and the results are more reliable.

It reduces rework and protects your reputation.

4. Compliance and audit readiness

Regulated markets demand a clear paper trail, and most teams build it reactively. Emails, spreadsheets, and disconnected systems create gaps that show up at the worst time.

Agentic AI logs everything. Every field extracted, every flag raised, every action taken is recorded and explainable.

Instead of scrambling for documentation, you get built-in audit readiness without extra effort.

Why humans still matter, just differently

Agentic AI doesn’t eliminate judgment. It makes room for it.

Underwriters don’t stop thinking. They stop digging. Ops leaders don’t get buried in intake. They oversee a smarter system.

That’s the real unlock: automation that moves the grunt work out of the way so people can focus on decisions, not mechanics.

How Are Leading Insurers and Brokers Using It Today?

Agentic AI is already reshaping operations inside brokers, MGAs, and carriers that have decided to stop waiting and start acting. Across the board, early adopters have one thing in common: they’re using AI to solve operational bottlenecks, not just experiment with chatbots or write better emails.

Real use, not pilot theater

We’re seeing underwriting teams use AI agents to process 50+ loss runs a day with no human prep.

Ops leads are deploying triage agents to route new business submissions the moment they hit the inbox.

Policy review agents are flagging compliance issues before bind, not after a costly rework.

The common thread? AI is acting, completing defined tasks in live production environments, with clear outcomes.

What early adopters are doing differently

They didn’t start with a massive transformation roadmap. They picked a high-friction, high-impact workflow, typically one that consumed hours of manual effort from skilled personnel, and deployed a focused AI agent to handle it.

Then they did the most important thing: they measured the outcome.

- How much faster did the work get done?

- How many errors were eliminated?

- How did this change underwriter capacity?

- What did it free people up to do instead?

Once they had results, they expanded. One agent became three. One team became five.

They didn’t chase scale before proof. They proved value, then scaled with momentum on their side.

It’s not just about tech, it’s cultural

The most successful teams are the ones treating Agentic AI as operational infrastructure. They’ve shifted their mindset from “let’s try a tool” to “let’s build a smarter process.”

It’s not about replacing people but about building systems that support the work humans are actually best at and removing everything else.

What Are the Risks of Ignoring AI and How Can Companies Future-Proof?

Let’s be clear – doing nothing isn’t neutral. It’s expensive.

Choosing not to engage with AI today doesn’t freeze your current state. It accelerates the gap between you and the firms that are already deploying it.

The risk isn’t AI. The risk is falling behind in how your business operates.

Operational drag compounds quietly and painfully

Most insurers and brokers didn’t notice the drag until COVID, hard market conditions, and shifting distribution models exposed every workflow inefficiency at once. Manual submission intake. Loss run spreadsheets. Policy QA passed through four different hands before bind.

These aren’t tech issues. They’re system design issues. And when volume goes up or market pressure tightens, those design flaws turn into revenue blockers.

Agentic AI doesn’t just add speed. It removes drag. Ignoring it means your cost to serve stays high while margins erode.

Your best talent doesn’t want to do low-leverage work

Underwriters didn’t sign up to copy data from PDFs. Ops managers don’t want to babysit inboxes. Smart people doing mechanical work is inefficient and demoralizing.

You risk losing high performers not because the job is too hard, but because it’s too manual.

Top teams are already rethinking the work. AI handles the structure, sorting, and surfacing. Humans do what humans are great at: judgment, negotiation, and strategy.

That shift is what keeps talent.

Manual workflows break under scrutiny

In regulated environments, repeatability and auditability matter. Manual processes are fragile. They rely on memory, email trails, and someone remembering to double-check the spreadsheet.

Agentic AI, by contrast, leaves a trail. Every action taken is explainable. Every flag is logged, and every decision has context.

When audits happen, or when something goes wrong, you don’t have to recreate history. It’s already there.

So how do you future-proof?

Don’t start with a platform. Start with a process.

Take a look at where your team is performing the same manual task dozens of times a day. Identify the workflows that require judgment, especially after a series of copy-paste steps.

That’s where agents go.

You don’t need to rip and replace your systems. You need to start building agent-ready infrastructure – clean handoffs, measurable outcomes, and people ready to supervise instead of scramble.

That’s what prepares you for scale.

Not more headcount. No more point solutions. Just smarter, more resilient operations built to evolve.

How Can You Evaluate AI Partners Who Understand Insurance?

You don’t need more vendors. You need fewer partners who actually understand the work.

There’s no shortage of AI startups promising to “transform” your workflows. Most of them haven’t spent a single day inside an underwriting team, sat through a broker call, or mapped how a quote becomes a bound policy.

If you want real outcomes, not experiments, you need partners who know the terrain.

Look for insurance-native AI teams rather than generalists

AI alone doesn’t solve anything. Context does.

An AI vendor that doesn’t understand what a loss run is, how E&S differs from admitted, or why triage matters for submission velocity isn’t going to help you move faster. They’ll build a tool you can’t use.

The best AI partners aren’t tourists. They’ve built systems inside underwriting desks. They understand claims leakage. They’ve seen how the work actually happens – flawed PDFs, incomplete apps, and all.

That knowledge shows up in the product and in the results.

Do they understand underwriting, claims, and compliance?

If they can’t speak fluently about renewal timelines, QA before bind, or audit prep, walk away.

You’re hiring technologists and process engineers who need to protect the integrity of regulated, high-stakes work.

Agentic AI sits in the flow of your business. If your partner doesn’t understand how risk decisions are made and documented, you’re building on shaky ground.

Demand transparency and explainability

AI that can’t explain itself is a liability.

Ask to see how outputs are generated. Ask what happens when the AI is unsure and how human reviewers fit into the loop.

You want systems that:

- Flag exceptions clearly

- Show which data was used

- Allow your team to review and override if needed

No black boxes. No hand-waving. Just AI that works the way your team thinks.

Avoid vague promises and recycled language

“AI-powered efficiency” means nothing if there’s no operational outcome.

Push for specifics:

- What exact task does this agent complete?

- How long does it take now? What changes with your system?

- How will my team interact with it day to day?

If the answer is a hand-wave toward “productivity gains,” they’re selling hype. Not infrastructure.

Real-World Insurance Use Cases (Happening Today)

Agentic AI is already embedded in the day-to-day workflows of forward-thinking carriers, brokers, and MGAs. These Bound AI agents are digital workers doing real tasks, at scale, right now.

Loss Run Analysis Agent

This agent ingests any loss run PDF, scanned, exported, or multi-carrier, and extracts structured data without templates. It flags missing policy years, spikes in frequency or severity, and large-loss outliers in real time. The result: underwriters get a clean dataset, a plain-language summary, and instant insight into historical risk, without spending hours rekeying or reading tables. It’s fully auditable and accurate enough to skip manual prep entirely.

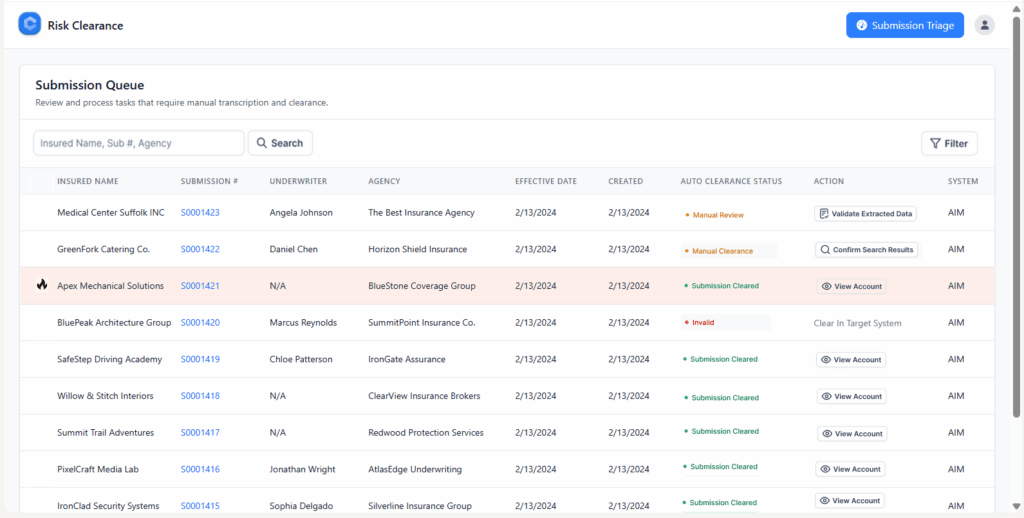

Submission Triage Agent

Instead of routing submissions manually, this agent evaluates every incoming file for completeness, urgency, and business fit. It can prioritize by line of business, detect missing documents, and automatically assign the right workflow. Underwriting desks no longer waste time sorting the pile. Brokers get faster responses, and high-potential deals stop getting buried.

Policy Checking Agent

This agent compares the final bound policy against quoted terms, referral conditions, and internal rules. It flags discrepancies, like incorrect limits, missing endorsements, or compliance gaps, before the policy leaves the door. That means no late-stage rework, no E&O exposure, and no scrambling before audit. The agent reviews every policy with consistent logic, every time.

SOV Processing Agent

Handling large, messy property schedules used to take hours of manual formatting. This agent reads SOVs in any format – Excel, CSV, embedded in PDFs – and structures the data automatically. It validates fields, flags errors, and prepares the file for downstream risk modeling or ingestion. Teams stop wrestling with columns and start underwriting faster.

RiskClear Digital Worker

RiskClear acts as a digital assistant for risk review, surfacing insights across all available documents and data points. It pre-reads submissions, loss runs, and coverage forms, identifies missing or inconsistent inputs, and builds a decision-ready file before an underwriter opens it. The goal isn’t speed for speed’s sake. It’s making sure risk gets evaluated with full context, every time. RiskClear turns fragmented information into a clear, actionable summary.

The Bottom Line

Agentic AI isn’t a concept you can afford to sit on. It’s already changing how forward-thinking insurers and brokers operate, from how submissions are triaged to how policies are checked and risks reviewed.

The point isn’t to replace people. It’s to replace inefficiency. The firms using AI agents today aren’t guessing. They’re moving faster, making fewer errors, and building leaner, more resilient operations, without burning out their teams.

If you’re still waiting for a perfect time to explore this, it’s already passed. Agentic AI is no longer a competitive advantage. It’s becoming the baseline.

The real question now is simple: Are your operations built for the way insurance actually works or for the way it used to?

Talk to the Bound AI team.