The insurance industry runs on speed and accuracy, always has and always will. One of the biggest blockers in underwriting and broking is risk clearance. Before a policy is bound, brokers and underwriters must verify whether the risk already exists, check for potential conflicts, and

For decades, this has been a slow, manual process. Brokers had to dig through emails, spreadsheets, and multiple systems to determine whether the wholesale agent had already submitted the risk, if the carrier had declined it, or if someone else was working on it.

Manual risk clearance and its associated downsides resulted in delays, duplication of work, and frustrated clients. For brokers, MGAs, and carriers, risk clearance automation allows faster decisions and cleaner pipelines.

The ultimate solution for the trouble of risk clearance is risk clearance automation. In this article, we’ll explain what risk clearance automation is, who’s using it, and why it matters in 2025 more than ever.

TL;DR (Too Long; Didn’t Read)

- Risk clearance is a slow, manual process that blocks deals.

- Risk clearance automation leverages AI, NLP, OCR, and machine learning to verify, match, and clear risks instantly.

- Carriers, MGAs, brokers, and insurtech companies are all expected to adopt risk clearance automation in 2025.

- The benefits of risk clearance automation include faster submissions, lower costs, higher accuracy, improved compliance, and stronger client relationships.

- Adoption matters now because clients demand speed, competition is tight, and AI is ready.

- Automation is impacting the whole insurance industry, including risk clearance.

What Is Risk Clearance Automation?

Risk clearance automation utilizes technology to assess, compare, and clear risks without requiring manual intervention. The technology used for risk clearance automation is mostly AI (artificial intelligence), NLP (natural language processing), OCR (optical character recognition), and ML (machine learning).

Manual risk clearance requires underwriters or underwriting assistants to search through multiple systems for duplicates, compare risk data with existing records, and follow compliance rules.

Manual risk clearance may sometimes take hours, especially with risks that have multiple locations or coverages.

With automation, AI can instantly process incoming risks. It scans submissions, matches them with existing records, and highlights duplicates or discrepancies. It applies rules consistently, with no fatigue or oversight.

Why Is Manual Risk Clearance a Problem?

Risk clearance sounds simple, and it is if you receive a perfect submission with all the documents in PDF format, with no subjectivity, a single location, and a single coverage. Even a minor inconvenience can significantly complicate and prolong the risk clearance process.

It’s not just the complexity of the policy that slows down risk clearance. Submitted documents arrive in various formats and forms, including PDFs, Word documents, Excel sheets, emails, and handwritten submissions, often missing crucial information.

Underwriting teams handle thousands of risks, especially during renewal season. Manually reviewing all these documents and then entering all this data into various systems is exhausting.

With manual entry, risks accumulate, and you may lose a client to your competitors. With risk clearance automation, underwriters, brokers, and carriers can avoid worrying about potential risks and losses.

Who Needs Risk Clearance Automation?

Risk clearance automation is already in motion. Large carriers are rolling out this initiative across their underwriting teams to gain speed and ensure compliance. MGAs rely on automation to process submissions more efficiently and better serve their brokers.

Brokers utilize AI-powered risk clearance tools to manage thousands of submissions each week, allowing their teams to concentrate on negotiation and client relationships. Finally, insurtech companies are building entire platforms around it, proving that risk clearance can be done in minutes instead of hours or even days. The adoption of automated risk clearance is widespread because the benefits are immediate.

Click here to read our article on “6 Reasons Why Brokers Are Turning to AI”.

The Key Benefits of Risk Clearance Automation

There are numerous benefits of risk clearance automation, with no significant downsides, making it highly popular among insurance companies, carriers, brokers, and MGAs.

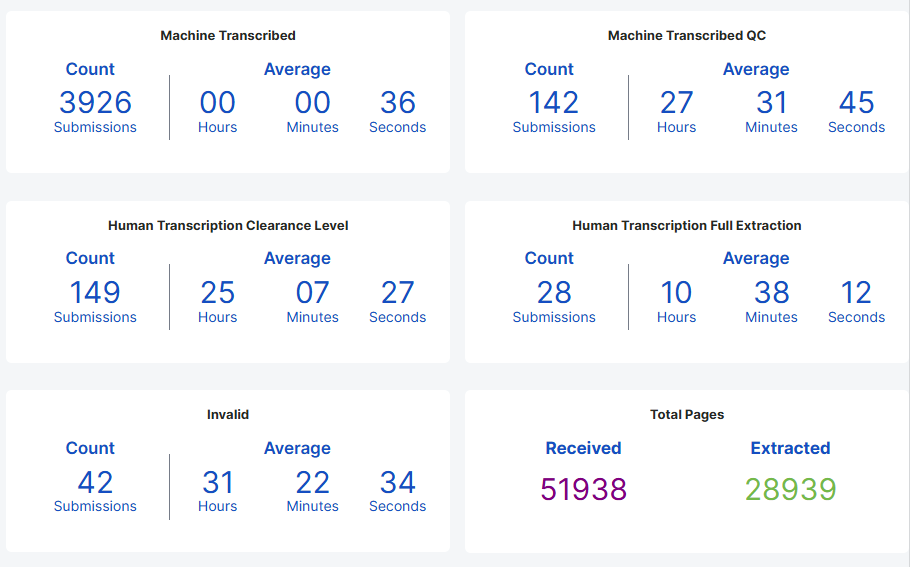

Risks are cleared in minutes instead of hours, reducing manual work and lowering costs, allowing smaller teams to manage higher volumes. AI ensures accuracy and compliance by consistently applying the same rules, eliminating missed steps.

Carriers can respond quickly, strengthening broker relationships, while clients benefit from faster answers and quicker deal closures. Additionally, teams gain scalability, enabling them to handle seasonal spikes without bottlenecks.

How Risk Clearance Automation Works

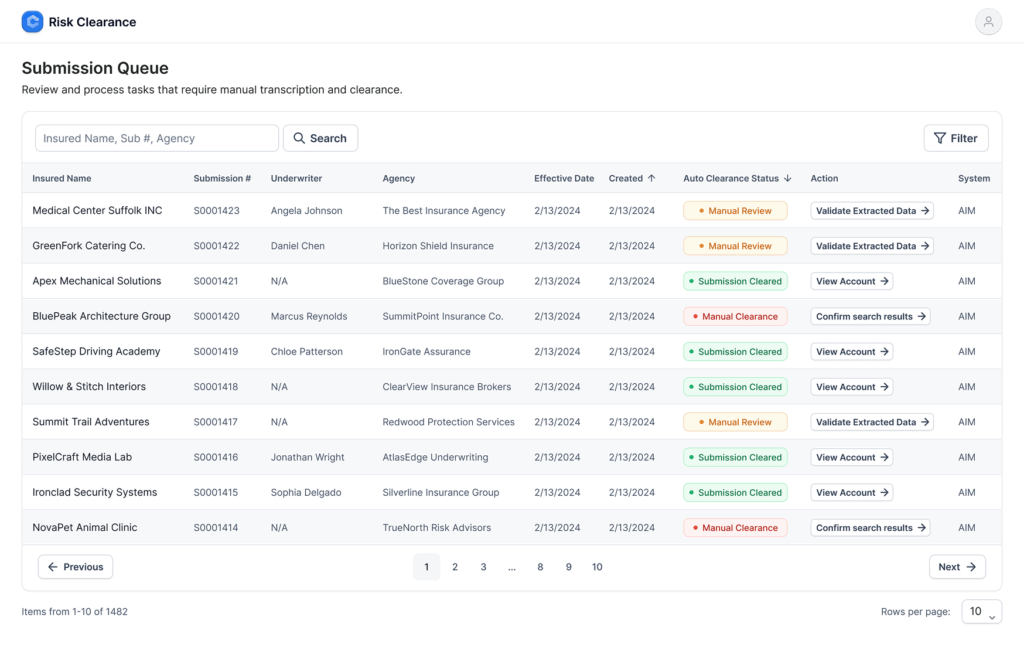

AI first ingests incoming submissions in any format, including PDFs, emails, and Excel files. With the help of OCR, the tool then extracts key data points such as name, location, limits, and terms, and matches them against existing records to flag duplicates or conflicts.

Compliance and underwriting rules are applied instantly, and the system either clears the risk automatically or flags it for review. As a result, only exceptions reach human teams, while standard risks are removed instantly.

Barriers to Adoption

Even with clear benefits, not everyone has immediately switched to AI. In fact, it took the insurance industry quite some time to adapt to AI and its benefits.

Common barriers include legacy systems that don’t integrate well with new tools, resistance to change from teams accustomed to manual methods, upfront cost concerns, despite the quick payoff, and poor data quality that makes automation more challenging to implement.

Insurance is a detailed and sensitive industry, and people didn’t trust that AI could do a good job with underwriting. With AI advancements and the increasing use of machine learning, most experts agree that adoption is inevitable, and the market is rushing.

Why Risk Clearance Automation Matters in 2025

Client expectations are higher than ever, and businesses are seeking rapid responses to meet these expectations. Competition is fierce, and the first broker to clear a risk and offer a quote usually wins the deal.

At the same time, compliance rules are stricter, making consistency and accuracy critical. Manual work is also costly, while automation reduces hours and overhead.

Most importantly, AI is now advanced enough to handle unstructured documents and extensive data sets with reliability. In short, the timing is perfect, as the pressure is high, and the tools are ready.

Why Choose Bound AI?

At Bound AI, we help brokers, MGAs, and carriers bring automation into their workflows without disruption. Our AI is designed for insurance from the ground up. That means it understands insurance documents, integrates with existing systems, and scales as your business grows.

If you’re ready to clear risks more quickly and stay ahead, click here to find out more about our RiskClear Digital Worker.

The Bottom Line

Risk clearance has long been a pain point in the insurance industry. It slows down deals, creates duplication, and frustrates both brokers and clients. With risk clearance automation, those bottlenecks disappear.

AI automates repetitive checks, enabling risks to be cleared more quickly, with fewer errors, and at a lower cost. The companies adopting it now are already gaining speed, efficiency, and competitive advantage. Those who stick to manual risk clearance will be unable to keep pace with the market and will eventually automate the process.

Risk clearance automation utilizes AI to process submissions, identify duplicates or conflicts, and apply compliance rules without manual intervention.

Large carriers, MGAs, brokers, and insurtech companies have already switched to risk clearance automation in 2025.

The benefits of risk clearance automation include speed, accuracy, compliance, lower costs, and improved broker and client relationships.

No, automation reduces manual work, freeing teams to focus on high-value tasks.