Statement of Values, or SOV, is a crucial document in property underwriting, particularly for large properties. The accuracy and completeness of this document directly influence pricing, risk selection, and even downstream claims performance.

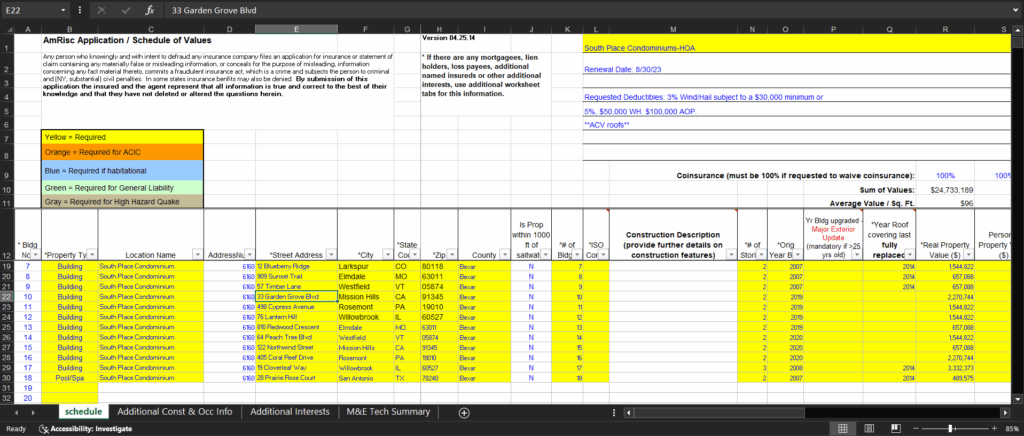

Although SOVs should contain clean and detailed information about locations, contents, equipment, replacement cost, actual cash value, occupancy, and more, they can often be messy, inconsistent, and time-consuming to review.

Manual analysis of SOVs not only slows you down but also increases the error ratio. Even the most experienced underwriters can miss some details when faced with spreadsheets full of unstructured and incomplete data.

SOV automation can refer to automating processes related to either Solenoid Operated Valves (SOVs) or Statement of Value (SOV) documents in the insurance industry. In this article, we’re covering the topic of SOV automation in insurance.

SOV automation in insurance is an instant solution for SOV processing. By replacing manual processing with AI and intelligent document processing (IDP), SOV automation can structure, validate, and analyze SOV data in a faster and safer way.

TL;DR (Too Long; Didn’t Read)

- Manual SOV processing is slow and inconsistent.

- AI-powered SOV automation structures and validates data across formats like Excel, PDFs, and scanned documents.

- Clean data helps underwriters make faster decisions.

- Automation reduces E&O risk by catching issues early.

- Carriers, MGAs, and brokers benefit from better quote-to-bind ratios and scalable underwriting capacity.

- Tools like Bound AI integrate seamlessly with your existing systems—no overhaul needed.

Downsides of Manual SOV Processing

One of the biggest challenges when processing SOVs is the variety of forms they come in. Some may say that Acord 139 is a standard SOV layout, but not all brokers or retailers use it for every single request.

Some insurance carriers require you to fulfill and submit their special form, while others will accept any type of SOV. Having this in mind, there are three common downsides of manual SOV processing.

Different Types of SOVs

There’s no standard SOV format across brokers or insureds. As mentioned above, Acord 139 serves as a standardized SOV in theory, but the reality is different. Some files come as clean Excel spreadsheets, others are PDFs with unstructured tables, and many lack essential fields like construction type, occupancy, or year built. Lack of standardization makes it nearly impossible to improve the manual SOV processing and find a solution for this downside.

Time-Consuming

Reviewing even a small SOV manually can take hours. For larger accounts, especially when it comes to real estate, manufacturing, or logistics, a full review could take days. Important risk indicators can easily get overlooked, such as a misclassified occupancy code or an outdated valuation method.

Incomplete or Inaccurate SOV

SOVs frequently include placeholder values, such as “TBD” or “Unknown.” Some buildings may be listed twice, others may be missing entirely. Without structured checks, these issues can go unnoticed.

What Is SOV Automation?

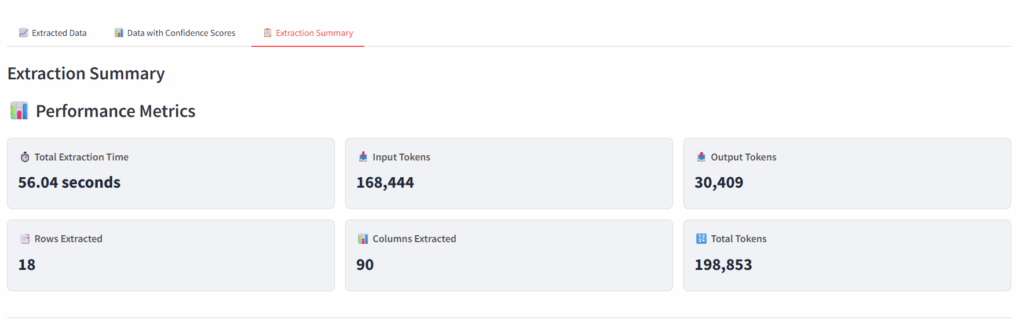

SOV automation in insurance involves processing SOVs using AI, machine learning, and natural language processing. SOV automation extracts, validates, and analyzes data from submitted SOVs automatically.

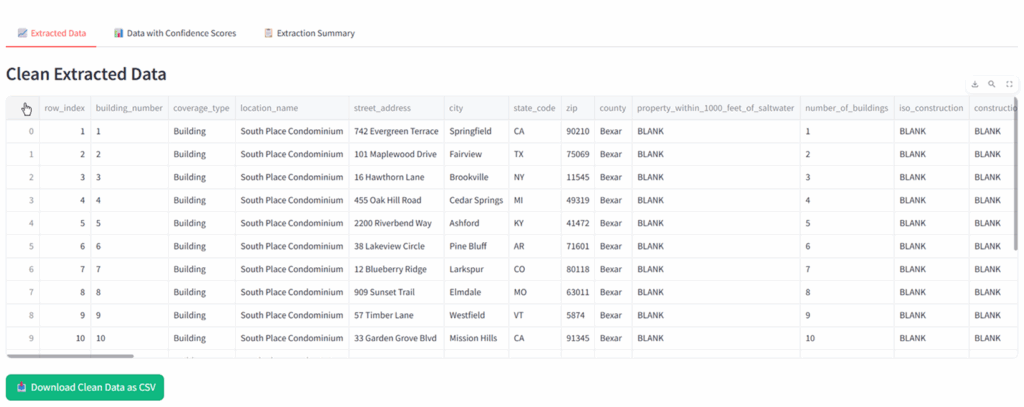

The goal of SOV Automation is to provide clean and structured data that underwriters can further use and rely on, while saving time and costs compared to manual processing of SOVs. One of the key benefits of SOV automation is document ingestion for various document types, such as Excel sheets, PDFs, scanned, or handwritten documents.

Some other key capabilities include field extraction, data validation, risk flagging, and integration with existing systems. While data validation detects missing or duplicated entries, risk flagging highlights exposures and routes flagged cases for human review.

Impact of AI on SOV Processing

Clean Data

AI-powered tools can convert even messy or semi-structured SOVs into normalized, consistent formats. This includes standardizing fields, removing duplicates, and aligning units. As a result, underwriters get clean input in minutes instead of hours.

External Data

When values are missing or unclear, AI can enrich them using trusted third-party sources such as geolocation APIs, public building records, historical claims, or fire protection databases. This creates a more complete picture of risk, even when the original submission doesn’t contain all the information.

Flags Irregularities

Automated SOV validation can instantly flag cases that are considered risky, such as high TIV in a high-crime zone, outlier building ages, or occupancy types that don’t match historical loss data. Human professionals can then review the flagged cases, and this helps underwriting teams focus their time where it matters most.

Reduce E&O Risk

With AI reviewing every row and every field, the likelihood of overlooking a key detail drops significantly. That translates to lower errors & omissions (E&O) risk and better protection for both the insurer and the insured.

Benefits of SOV Automation for Carriers, MGAs, and Brokers

SOV automation is a game-changer for every stakeholder in the property insurance value chain. Whether you’re a carrier, MGA, or broker, automating statement of values processing can radically improve how you handle property data at scale. Below are the key ways SOV automation creates tangible value across underwriting operations, customer experience, and profitability.

Better Quote-to-Bind Ratio

Instead of spending days cleaning data, underwriters can go straight into risk evaluation and pricing. That means your underwriters can start pricing and risk assessment immediately, helping you respond faster to brokers and win more business in competitive markets.

Data Quality and Consistency

AI ensures that every SOV is reviewed using the same set of rules and logic. It flags duplicates, detects missing fields, standardizes formats, and enriches data where possible. This improves the integrity of your underwriting process and reduces variance across your book of business.

Increased Underwriting Capacity

When your team isn’t bogged down by manual data cleanup, they can focus on strategic underwriting decisions. This allows a leaner team to manage more submissions without compromising quality, enabling scale without a proportional increase in staffing.

Broker & Client Experience

As AI gains popularity in the market, it becomes increasingly challenging to keep up with the competition while still relying on manual work. By implementing AI, faster turnaround and fewer back-and-forths over missing data create a smoother, more professional experience for brokers and insureds. The process feels seamless, and you gain a reputation for speed and reliability.

Compliance & Audit Results

Each step of the data validation process is logged, creating a digital record of what was submitted, what was corrected, and how the final decision was made. You will never have to dig through your recycle bin or trash mailbox to find a lost document. This makes it easier to pass audits, demonstrate regulatory compliance, and meet internal governance standards.

Bound AI SOV Processing Agent

Bound AI’s SOV Automation solution is built specifically for the insurance industry. Our AI models are trained on real underwriting data and understand the nuances of location risk, construction class, and industry codes. In other words, Bound AI reads the insurance language and understands the meaning of each field, contrary to just seeing numbers and letters.

With Bound AI, you get 99% extraction accuracy, automated risk detection and scoring, custom validation rules, and seamless integration. Find more information about the Bound AI SOV Processing agent here.

Integration of Bound AI

Modern SOV automation solutions like Bound AI are built to integrate with existing platforms, both modern APIs and legacy policy systems. You can start seeing value quickly without needing to rip and replace your existing tech stack.

Ready to modernize your operations? Let’s talk.

The Bottom Line

The Statement of Values is a highly valuable document in property underwriting. If your SOV data is incomplete, inaccurate, or unstructured, it triggers a chain reaction that affects subsequent underwriting operations, ultimately delaying quotes, binders, and policies.

SOV automation gives underwriters the tools they need to make confident decisions. It replaces manual processes with intelligent validation and brings great benefits to the table.

If you’re ready to reduce operational friction, improve underwriting accuracy, and stay competitive in today’s market, it’s time to make SOV automation part of your strategy.

Want to see it in action? Book a demo with Bound AI today.