Insurance operations face growing pressure to move faster, make better decisions, and deliver consistent service. Claims, FNOL, and MTAs sit at the centre of this pressure because they rely on information that arrives in unstructured formats.

Insureds and agents often submit PDFs, sheets, images, photos, and handwritten applications. Brokers forward endorsements, certificates, and change requests. Every workflow depends on documents that must be read, interpreted, and converted into data before the process can move forward.

Insurance document intelligence changes standard workflows that still rely on manual document handling, offering a modern solution to the old problem.

TL;DR

- Document intelligence converts unstructured insurance documents into structured, accurate data instantly.

- With IDP, ML, and AI, insurance document intelligence eliminates slow, manual document handling and improves speed, accuracy, and consistency across the entire policy lifecycle.

- Claims, FNOLs, and MTAs become faster, clearer, and more reliable when teams work from complete, validated data rather than PDFs and email threads.

- Downstream benefits include stronger data quality, better reserving and pricing insight, reduced leakage, and greater confidence in analytics.

- Bound AI delivers insurance-specialised document intelligence that automates data extraction and validation, enabling insurers and MGAs to operate with modern speed and precision.

What is Document Intelligence in Insurance?

Document intelligence in insurance refers to the use of specialized AI tools that can read, understand, and structure information from unstructured documents. Document intelligence is often helpful with claims processing, submissions, risk clearance, and more underwriting processes.

By leveraging OCR but not relying solely on it, document intelligence interprets context, extracts relevant fields, identifies inconsistencies, and validates information against insurance rules using machine learning and AI.

Document intelligence turns PDFs, images, emails, and sheets into reliable data that systems and teams can use immediately.

The benefits of document intelligence in insurance include faster workflows, improved data quality, and reduced operational burden of handling documents across the policy lifecycle.

Claims, FNOL, and MTAs Hit a Wall Without Better Data

Claims, FNOL, and MTAs all rely on extracting the correct information from supporting documents. The volume grows every year, and the formats only get more inconsistent.

Handlers spend hours reading PDFs, interpreting email threads, and typing information into claims or PAS systems. The manual handling slows the process and increases error rates, especially during seasonal spikes or complex cases.

The problem compounds as the data moves downstream. Inconsistent or incomplete data increases leakage, weakens reserving accuracy, and erodes confidence in analytics. The workflow slows because every decision depends on someone manually validating information.

Without a new model for understanding documents at scale, the industry cannot deliver the speed, accuracy, and consistency that modern insurance operations require.

Why Document Intelligence Becomes the New Operational Layer of Insurance Underwriting

Document intelligence in insurance underwriting processes incoming documents with insurance-specific logic. It reads context, understands meaning, and converts long-form narrative text into structured information that an insurer can trust.

When a claims file arrives, document intelligence extracts names, dates, locations, incident descriptions, financial details, and relevant context.

When an MTA request lands in an inbox, it identifies the requested changes, checks for inconsistencies, and validates the information against rules, removing manual interpretation from the workflow. Teams receive clean, structured data as soon as the document enters the organisation.

The process moves faster because the information already meets internal standards. The organisation gains a consistent, reliable data foundation rather than relying on human interpretation.

How FNOL Changes When Documents Turn into Data

The FNOL stage shapes the entire claim, as early inaccuracies ripple through every downstream decision. When the initial documentation arrives as unstructured content, handlers must extract and validate basic facts before progressing the case.

Document intelligence changes the whole FNOL experience by interpreting the complete first submission. It understands loss descriptions, dates, supporting evidence, and narrative context. The system automatically detects incomplete information early and flags discrepancies immediately.

Handlers receive a structured case file instead of raw documents. They begin the process with a fuller, more precise understanding of the incident. Cycle times shorten, reserving improves, and operational leakage decreases because the foundation of the claim is built on accurate data rather than manual interpretation.

How Claims Handling Becomes Faster and More Consistent

Claims handlers spend a large portion of their time reading documents rather than adjusting claims. Long adjuster reports, invoices, medical records, and correspondence all require interpretation before anyone can act.

Document intelligence removes the administrative burden of claims handling. If you’re using a trusted AI-powered tool, it extracts financial details from invoices, identifies key facts from reports, and highlights inconsistencies that may require attention. The machine produces a structured view of the case that flows into the claims system and reporting tools.

Handlers act on clean information instead of deciphering documents. With clean data readily available, the decision-making process becomes faster and easier.

Document intelligence in insurance also strengthens compliance, as every extracted field provides traceability and auditability. Instead of relying on manual data entry, underwriters gain a consistent information stream that improves operational accuracy.

How MTAs Move Faster with Document Intelligence

MTAs introduce friction because they often arrive as emails with attachments, scanned documents, or certificates that lack a standardised structure.

Operations and underwriting teams spend time deciphering the request, identifying what change, and confirming the updates against rules, creating slow cycle times and a risk of misinterpretation.

Insurance document intelligence interprets these submissions as soon as they arrive. With intelligent document processing (IDP), the system reads endorsements, certificates, and emails, identifies the requested risk changes, validates them, and highlights gaps or conflicting information.

The team works from structured inputs rather than raw documents. Cycle times improve, misunderstandings decrease, and policies are updated the first time.

Click here to read a full article on Intelligent Document Processing (IDP) in Insurance.

The Benefits of Document Intelligence in Insurance

The immediate advantage of document intelligence is faster processing and fewer errors. The deeper advantage is improved data quality. When the insurer captures structured, accurate, and complete information at the point of entry, every downstream system benefits.

Pricing models operate on cleaner data. Fraud detection becomes more precise. Reserving and forecasting rely on consistent inputs. Leadership gains confidence in operational insight because the data remains consistent from the moment it enters the workflow.

Data quality becomes an inherent part of the process, rather than a manual clean-up task.

Transforming Insurance Workflows with Bound AI

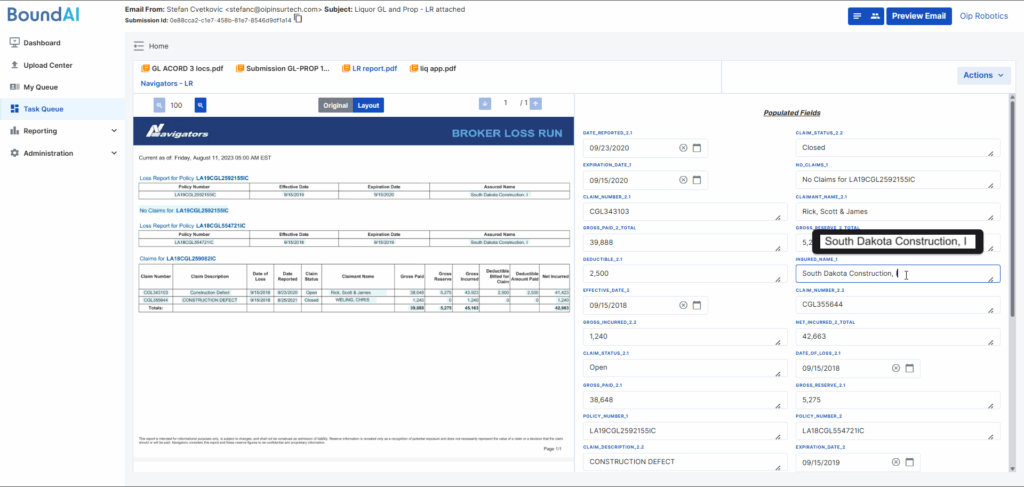

Bound AI is the proprietary insurance platform that we created to fix our own problems. As people who spent years underwriting manually, we know what it’s like.

We designed Bound AI, an insurance-specialized AI system, to turn messy, unstructured insurance documents into clean, reliable data the moment they enter your organisation.

Bound AI reads claims files, FNOLs, submissions, SOVs, acords, endorsements, invoices, and broker emails with insurance-specific intelligence, and instantly extracts the details your teams need.

Your claims, underwriting, and ops teams move faster because they start with complete, structured data instead of PDFs they need to interpret. Your leadership gains deeper insight because data is consistently and accurately entered into your systems.

Ready to transform your workflows? Book a demo and start your transformation now.

The Bottom Line

Claims, FNOL, and MTAs remain among the most document-heavy areas in insurance. They slow down without reliable data and weaken when they rely on manual interpretation.

With document intelligence, insurance carriers, MGAs, agents, and brokers gain faster cycle times, more consistent decisions, stronger data quality, and a better foundation for analytics and automation.

The companies that adopt document intelligence early will move faster, operate more efficiently, and build a competitive advantage as the industry shifts toward data-driven operations.