Insurance brokers have relied on manual work for as long as the industry has existed. First, it was the paper, and later scanned files and PDFs, but the manual entry work remained the same. After long hesitation, we can finally say that insurance brokers are turning to AI and relying on technology to handle some of their work.

But why? Why were the brokers hesitant to rely on AI agents? Why did they ultimately turn to AI anyway? In this blog, we’ll look at six clear reasons why insurance brokers are using AI to transform their daily work.

TL;DR (Too Long; Didn’t Read)

- Insurance brokers have relied on manual work for years.

- AI helps reduce errors, save time, and better serve clients.

- 6 key reasons brokers use AI:

- Faster risk clearance with automation.

- Smarter policy checking with fewer mistakes.

- Better client experience with quick answers.

- Improved claims accuracy and fraud detection.

- Saving time on repetitive tasks like data entry.

- Growing business with insights and automation.

- AI doesn’t replace brokers; it makes their work easier.

- Brokers who adopt AI today gain a significant advantage going forward.

What Is AI in Insurance?

AI, or Artificial Intelligence, refers to technology that mimics human thinking and behavior to perform various tasks. While it doesn’t replace people, AI can analyze and process large volumes of data faster and more efficiently than humans.

In insurance, AI is being used to handle many of the tasks that once took brokers hours or even days to complete. It can read lengthy policy documents, extract key terms, and compare them with client needs. It can also scan risk data, verify compliance with rules, and flag missing or incorrect details.

AI helps insurance brokers reduce errors, streamline workflows, and deliver a smoother client experience. With the help of AI, brokers don’t have to spend their days buried in forms and spreadsheets. Instead, they can focus on guiding clients, providing advice, and ensuring coverage really fits.

1. Faster Risk Clearance

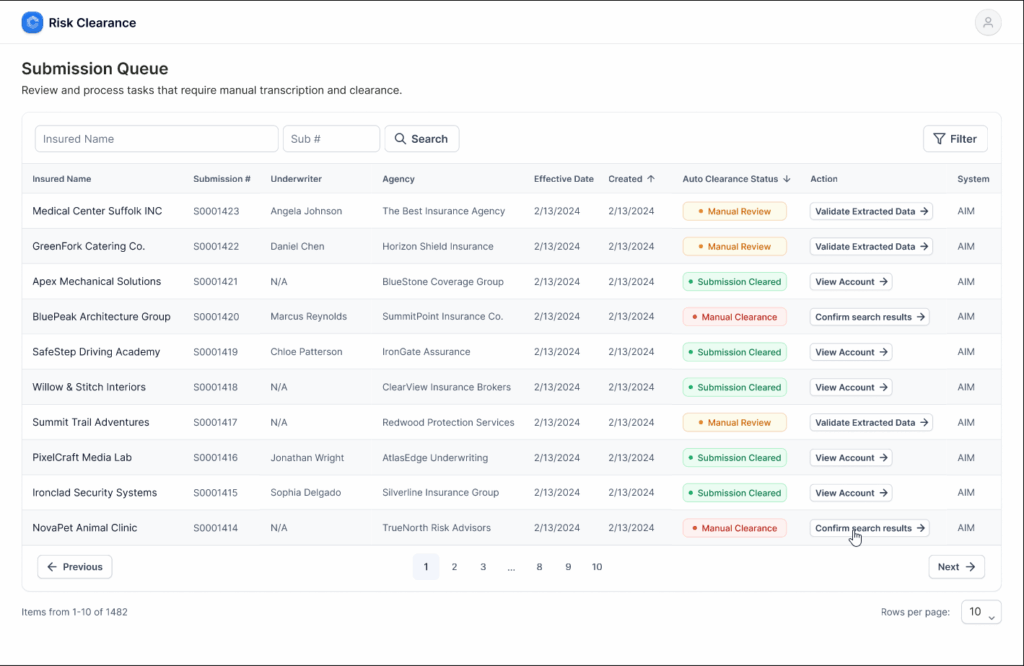

Risk clearance is one of the most challenging tasks for insurance brokers. They need to verify client details, review policy rules, and comply with industry requirements before proceeding. Risk clearance can take hours or sometimes even days.

AI enables faster risk clearance without compromising quality and accuracy. Thanks to machine learning, OCR, and NLP, insurance AI tools can read forms, match data, and flag issues in minutes. Brokers no longer have to dig through piles of documents.

With risk clearance automation, the process is smooth and quick, yet the brokers are not losing their jobs to AI, and probably never will. Risk clearance automation saves brokers time and provides clients with faster responses, allowing them to focus on more complex underwriting.

Ready to transform your risk clearance process? Check out our Risk Clearance Digital Worker.

2. Smarter Policy Checking

Insurance policies are lengthy, complex, and filled with details. Single-location policies are already complex enough; let’s not even discuss multiple locations, different coverages, or different class codes. A single mistake can cost a broker money and trust.

AI tools can read and check policies line by line. They can compare terms and forms, identify gaps, and highlight missing details. Instead of going through hundreds of pages, brokers get a clear report from AI.

Automation makes policy checking less stressful and more accurate. Brokers feel more confident, and clients feel more secure.

3. Better Client Experience

Clients expect quick answers and simple service. They don’t want to wait days to know if they’re covered or not. Insurance brokers work with carriers and wholesale agents, and both sides expect the best service, which relies on speed and accuracy.

AI helps brokers deliver a better client experience. For example, AI chat assistants can answer simple client questions at any time of the day.

AI can also suggest coverage options based on client needs, while the ultimate decision remains with the broker. Clients feel valued and supported. It also helps brokers build long-term trust.

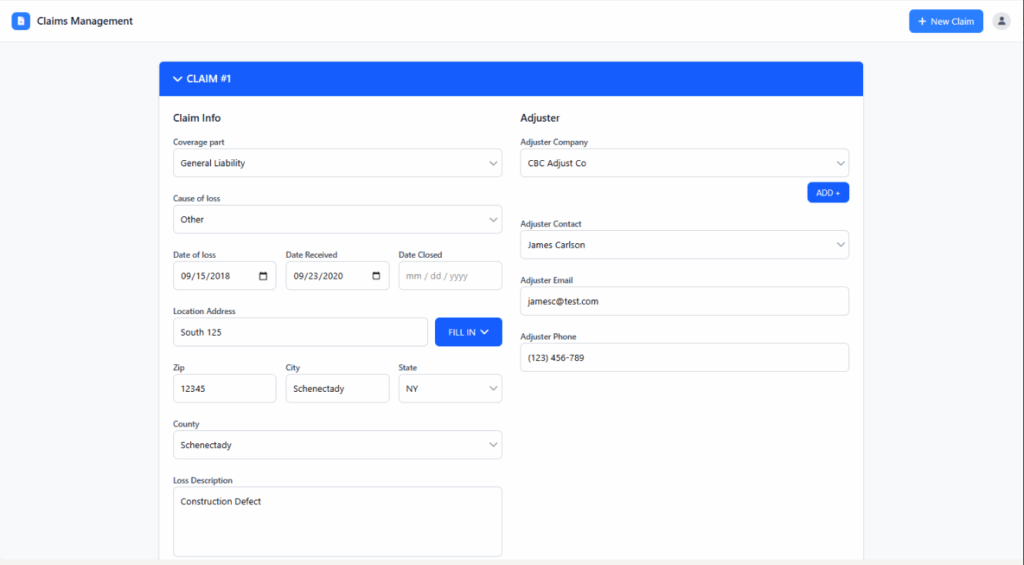

4. Improved Claims Accuracy

Claims are often slow and frustrating for both the insureds and brokers. Many mistakes occur when reviewing forms, invoices, and regulations.

AI can scan claims documents and spot errors before they cause problems. It can also verify if a claim is valid, reducing the risk of fraud.

With AI, brokers can help clients achieve fair claim results more efficiently, benefiting both parties.

5. Saving Time on Repetitive Work

Brokers spend more than half of their working hours on repetitive tasks, including submission triage, data entry, copying details, and sending follow-up emails.

AI handles repetitive work with ease. It can auto-fill forms, update client records, and even send reminders. With AI, insurance brokers can save hours on tedious tasks.

By saving time, brokers can focus on what truly matters: advising clients and closing deals.

6. Growing the Business

Every broker wants to grow their business, but growth is challenging when most of the time is spent on manual work.

AI changes that. With faster risk clearance, smarter policy checking, and better client service, brokers can take on more clients without burning out.

AI also gives brokers insights into client data. The insight and outputs help the brokers spot trends, upsell coverage, and create stronger client relationships.

The result: more revenue, stronger reputation, and sustainable growth.

How AI Is Transforming the Insurance Industry

The insurance industry has traditionally been a document-heavy and slow-to-change sector. But with AI, things are different. Brokers no longer rely on endless paperwork. They can now move faster, serve better, and grow stronger.

From risk clearance automation to client support, AI is transforming the way brokers operate daily. The industry is moving from manual processes to digital solutions. And brokers who adopt AI early will stay ahead of the competition.

Why Did Brokers Avoid AI?

The reason brokers have been hesitant about AI for years is the nature of the industry itself. Everyone was scared to rely on it. Most error and omission insurance doesn’t cover mistakes by AI in case one happens.

Understandably, you want to be in charge of everything in the insurance industry, but this problem has been solved already. With human-in-the-loop, AI routes everything that seems slightly irregular for human review.

A high level of machine accuracy actually beats the human eye, which sometimes misses essential details. With numerous advantages and no downsides, insurance brokers have begun to leverage AI for specific tasks.

The Future of Brokers and AI

Although insurance is behind other industries in adopting AI, it is currently at its peak in automating repetitive tasks.

AI is not here to replace brokers. It is here to support them. Brokers continue to play a vital role in advising clients, fostering trust, and ensuring coverage aligns with their actual needs.

What AI does is remove the slow, repetitive, and error-prone parts of the job, while making brokers more efficient and valuable.

In the future, AI will continue to evolve and become increasingly intelligent. Brokers who utilize AI tools now will be well-prepared for the future.

If you’re an insurance broker ready to begin your transformation, click here to schedule a free consultation.

Bound AI – Your Trusted Insurance Partner

Bound AI is an AI-powered software designed explicitly by insurance underwriters to handle the most repetitive underwriting tasks. Our team of tech experts with underwriting experience has worked hard to create a tailored AI for the industry.

Ready for automation? Choose your AI agent:

- Submission Triage Agent

- RiskClear Digital Worker

- Loss Run Analysis Agent

- SOV Processing Agent

- Policy Checking Agent

The Bottom Line

The transformation of the insurance industry is clear. Insurance brokers are turning to AI because it offers numerous benefits with no downsides.

Each reason shows how AI reduces stress, saves time, and increases trust.

The change is already here, and it’s only getting stronger. Machine learning engineers are yet to discover the full capabilities of artificial intelligence, and they expect to automate even more underwriting tasks in the future.

Brokers who embrace AI today will be the leaders of tomorrow.

Insurance brokers are using AI to save time, reduce errors, and deliver faster service. AI handles repetitive tasks, allowing brokers to focus on their clients.

No. AI is a support tool, not a replacement. Brokers continue to provide advice, build trust, and ensure coverage meets clients’ needs. AI makes their work easier and faster.

AI can handle submission triage, policy checks, loss-run analysis, SOV processing, claims review, and other repetitive tasks.