Smarter Quoting Starts Here.

Underwriting Desk Copilots

The cost of quoting shouldn’t be burned hours, missed revenue, and frustrated agents.

The Underwriting Desk Copilots are modular AI assistants that plug into your existing quoting or policy systems to handle repetitive setup, validation, and follow-through, without replacing your PAS or rating engine.

Think of them as digital underwriting assistants.

Generating complete policy documents

Setting up files in minutes

Validating against appetite

Collecting carrier quotes

They’re already live with multiple MGAs and carrier partners, supporting quote processing at scale, without adding headcount. One team used the copilots to increase daily quote output by 30% during peak season, with a 2-point lift in bind ratio.

Faster quoting. No rip-and-replace. Grows with you, with no additional investments in teams needed.

Static Systems in Dynamic Workflows

Most policy administration systems were built to record, not respond. They store only what’s needed to rate and invoice a risk, but don’t support quoting agility or submission triage.

Mistakes pile up. And customer service suffers.

The result? Premium leakage, higher costs, and delayed responses that send producers elsewhere.

Meet Your Underwriting Desk Copilots

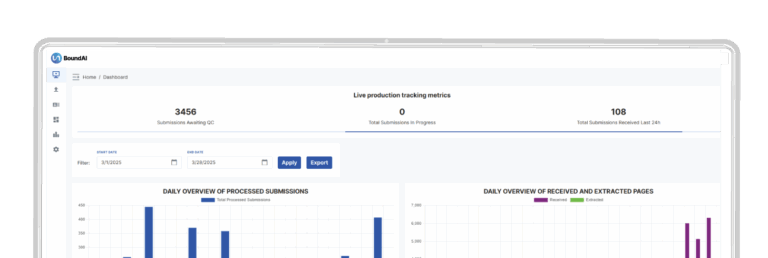

Bound AI’s Underwriting Desk Copilots replicate the work of a robust UW support team at a digital scale.

From there, copilots fetch quotes from carrier portals, flag policy inconsistencies, and help route clean risks through your internal systems.

Built by insurance ops veterans, our copilots are trained on thousands of workflows and risk types across the most complex product lines.

What It Does

Few-Step Product & Class Setup

Configure coverages, limits, deductibles, and class codes in just a few clicks and capture everything upfront. |

Dynamic Quoting Engine

Match submissions with carrier appetite and automatically collect, compare, and propose winning quotes. |

Policy Forms Management

Use the structured data to populate form sets and issue policies, all from a single interface. |

AI Submission Triage

Validate completeness, quality, and appetite. Our RiskClear agent flags renewals, clears new business, or routes declines automatically. |

What You Can Expect

Cut quote cycle time by up to 60%

Process submissions with up to 200 data points collected at intake

Enable UW teams to handle 30% more quotes

Increase bind ratio by 1–3%

Improve retention by 10% through on-time, accurate policies

Industry Snapshot

A multi-line specialty MGA rolled out Bound AI’s Underwriting Desk Copilots across Property, Casualty, and Marine programs. In just 90 days, they cut quoting time by 60%, while underwriters processed 30% more submissions, with no added headcount.

Collaborating on risk in a unified portal streamlined operations, improved quote accuracy, and boosted quote-to-bind conversion by 3%.

“Bound AI transformed how our underwriters work. What used to take 3–4 tools and hours of back-and-forth is now handled in one portal – faster, cleaner, and with fewer mistakes.” – Director of Underwriting Operations, Specialty MGA

See how Bound AI turns every quote, policy, and submission into instantly searchable, usable data, no rekeying required.